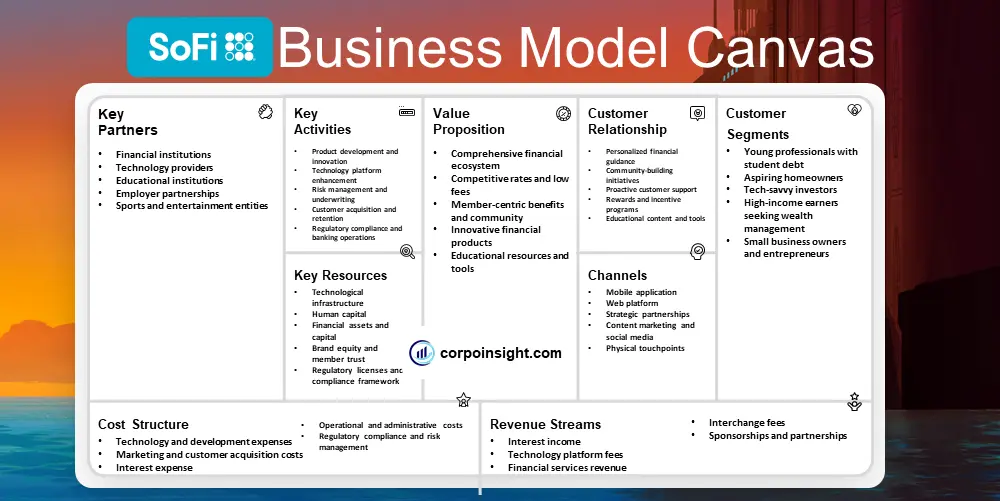

SoFi Business Model Canvas 2025: : Thriving in Fintech

SoFi, a fintech company revolutionizing personal finance, offers a comprehensive suite of banking and investing solutions that cater to millennials and Gen Z, while also challenging traditional financial institutions with its innovative, mobile-first approach. In this SoFi Business Model Canvas, I will identify its customer segments, value proposition, revenue streams, channels, customer relationships, key activities, key resources, key partners, and cost structure.

Interesting fact!

SoFi has an unusual employee perk: it offers up to $200 per month to employees for paying off their student loans.

SoFi Competitors

Robinhood | Chime | Affirm | Square | Stripe | Coinbase | Avant | LendingClub | Prosper | Betterment

Customer Segments – SoFi Business Model Canvas

Young professionals with student debt: SoFi primarily targets millennials and Gen Z individuals who have accumulated student loan debt and are seeking refinancing options; this demographic often includes recent graduates from prestigious universities who are entering high-earning career paths.

Aspiring homeowners: The company caters to first-time homebuyers, particularly those in their late 20s to early 40s, by offering competitive mortgage rates and innovative programs that help overcome common barriers to homeownership, such as high down payment requirements.

Tech-savvy investors: SoFi attracts individuals who are comfortable with digital platforms and are looking for low-cost, user-friendly investment options; this segment includes both novice investors seeking education and more experienced traders interested in cryptocurrency and automated investing.

High-income earners seeking wealth management: While initially focused on younger demographics, SoFi has expanded its services to appeal to high-net-worth individuals who desire comprehensive financial planning, tax optimization strategies, and personalized wealth management solutions through its SoFi Wealth platform.

Small business owners and entrepreneurs: Recognizing the growing gig economy and startup culture, SoFi has begun targeting small business owners and self-employed individuals with tailored lending products and financial management tools designed to support their unique needs and growth aspirations.

Value Proposition – SoFi Business Model Canvas

Comprehensive financial ecosystem: SoFi offers a one-stop solution for various financial needs, including banking, investing, loans, and insurance, which enables users to manage their entire financial life within a single platform, thereby streamlining their financial management and potentially reducing costs associated with multiple service providers.

Competitive rates and low fees: By leveraging technology and operating primarily online, SoFi can offer more attractive interest rates on loans and savings accounts, as well as lower fees for investing, which is exemplified by their high-yield checking and savings account offering up to 4.60% APY as of 2024.

Member-centric benefits and community: SoFi provides unique perks such as career coaching, financial planning sessions, and networking events, fostering a sense of community among its members; additionally, their unemployment protection program offers loan forbearance to members who lose their jobs, demonstrating a commitment to supporting customers through financial challenges.

Innovative financial products: The company continually introduces cutting-edge offerings, such as its fractional share investing and cryptocurrency trading capabilities, which appeal to tech-savvy users seeking modern financial solutions; furthermore, their early paycheck access feature allows members to receive direct deposits for up to two days earlier than traditional banks.

Educational resources and tools: SoFi emphasizes financial literacy by providing extensive educational content, including articles, videos, and interactive tools, which empower users to make informed financial decisions; their SoFi Insights feature, for instance, offers personalized financial tracking and goal-setting capabilities to help members improve their overall financial health.

Revenue Streams – SoFi Business Model Canvas

Interest income: SoFi generates substantial revenue from interest on loans, particularly student loan refinancing, and personal loans; in Q4 2023, the company reported $458 million in net interest income, representing a significant portion of their total net revenue of $615 million for the quarter.

Technology platform fees: Through its Galileo and Technisys acquisitions, SoFi earns fees by providing financial technology services to other institutions; this segment contributed $94 million to revenue in Q4 2023, demonstrating the company’s successful diversification into B2B fintech solutions.

Financial services revenue: SoFi earns revenue from various financial products, including investment management fees, cryptocurrency trading commissions, and referral fees from partners; this segment saw impressive growth, with Q4 2023 revenue reaching $94 million, a 25% increase year-over-year.

Interchange fees: As users increasingly adopt SoFi Money accounts and utilize their debit cards, the company earns interchange fees from merchants on transactions; while specific figures aren’t disclosed, this revenue stream is part of the growing financial services segment.

Sponsorships and partnerships: SoFi leverages its brand through strategic partnerships and sponsorships, such as the naming rights for SoFi Stadium, which not only generates direct revenue but also enhances brand visibility and customer acquisition opportunities across various financial services.

Channels – SoFi Business Model Canvas

Mobile application: SoFi’s primary channel is its mobile app, which saw a 44% year-over-year increase in downloads in 2023, offering users a comprehensive suite of financial services; the app’s user-friendly interface and integrated features, such as automated investing and bill tracking, contribute significantly to customer acquisition and retention.

Web platform: Complementing the mobile app, SoFi’s web platform provides a robust online experience for users who prefer desktop access; this channel supports complex financial operations and detailed analytics, catering to both individual investors and those seeking in-depth financial planning tools.

Strategic partnerships: SoFi expands its reach through collaborations with universities, employers, and other financial institutions; for instance, its partnership with Galileo Financial Technologies has enabled SoFi to offer banking services to over 100 million accounts, significantly broadening its potential customer base.

Content marketing and social media: Leveraging a strong digital presence, SoFi engages potential customers through educational content, webinars, and social media campaigns; their YouTube channel, boasting over 100,000 subscribers, serves as a key platform for financial education and brand awareness.

Physical touchpoints: While primarily digital, SoFi maintains a select physical presence, including its high-profile sponsorship of SoFi Stadium in Los Angeles, which not only increases brand visibility but also serves as a unique channel for customer engagement during events and tours.

Customer Relationships – SoFi Business Model Canvas

Personalized financial guidance: SoFi offers complimentary access to certified financial planners, which sets it apart from traditional online-only platforms; this service, utilized by thousands of members annually, fosters trust and loyalty by providing personalized advice tailored to each customer’s unique financial situation and goals.

Community-building initiatives: Through SoFi’s networking events and online forums, members can connect with like-minded individuals and industry professionals; for instance, their “SoFi Together” virtual events series, launched in 2020, has engaged over 100,000 participants, creating a sense of belonging and shared financial journey among users.

Proactive customer support: SoFi employs a multi-channel support system, including phone, email, and chat options, with extended hours to accommodate various time zones; their reported average response time of under 2 minutes for chat support in 2023 demonstrates a commitment to prompt and efficient customer service.

Rewards and incentive programs: To encourage engagement and product adoption, SoFi implements various rewards programs, such as their referral bonuses and the SoFi Money account’s cashback offerings; in 2023, they introduced the SoFi Credit Card, which rewards users with up to 3% cash back when redeemed into SoFi investment accounts.

Educational content and tools: SoFi invests heavily in financial education, offering a wealth of resources through its blog, webinars, and interactive tools; their “SoFi Learn” platform, which saw a 30% increase in user engagement in 2023, empowers customers to make informed financial decisions while positioning SoFi as a trusted advisor.

Key Activities – SoFi Business Model Canvas

Product development and innovation: SoFi continually expands its product offerings, evidenced by the launch of SoFi Credit Card in 2020 and SoFi Invest’s cryptocurrency trading feature in 2019; this ongoing innovation, supported by substantial R&D investments, enables the company to meet evolving customer needs and stay competitive in the fintech landscape.

Technology platform enhancement: Following the acquisition of Galileo in 2020 and Technisys in 2022, SoFi has been integrating and enhancing its technology infrastructure; this activity not only improves its services but also positions SoFi as a B2B fintech provider, with Galileo processing over $100 billion in annualized payment volume by Q4 2023.

Risk management and underwriting: As a financial services provider, SoFi engages in sophisticated risk assessment and underwriting activities, particularly for its lending products; the company’s ability to maintain a low charge-off rate of 1.23% for personal loans in Q4 2023 demonstrates the effectiveness of these critical activities.

Customer acquisition and retention: SoFi focuses on expanding its member base through targeted marketing campaigns and referral programs; this effort resulted in a 44% year-over-year increase in total members, reaching 5.2 million by Q4 2023, while also maintaining a high Net Promoter Score of 74 in the same period.

Regulatory compliance and banking operations: Since obtaining a national bank charter in 2022, SoFi has been actively engaged in banking operations and ensuring compliance with regulatory requirements; this key activity allows the company to offer a wider range of financial products and services while potentially reducing funding costs.

Key Resources – SoFi Business Model Canvas

Technological infrastructure: SoFi’s robust technology platform, bolstered by the acquisitions of Galileo and Technisys, serves as a critical resource; this integrated system not only supports SoFi’s operations but also powers financial services for other institutions, processing over 7 billion transactions in 2023 alone.

Human capital: SoFi’s workforce, which grew to over 4,000 employees by the end of 2023, includes skilled professionals in finance, technology, and customer service; the company’s ability to attract and retain top talent, particularly in competitive fields like AI and machine learning, is crucial to its ongoing innovation and growth.

Financial assets and capital: With a strong balance sheet showing $1.5 billion in cash and cash equivalents as of Q4 2023, SoFi possesses the financial resources necessary to fund its operations, invest in new technologies, and weather economic uncertainties; this financial stability is further enhanced by its ability to attract institutional investors.

Brand equity and member trust: SoFi’s brand, valued at over $2 billion in 2023, represents a significant intangible asset; the company’s high Net Promoter Score and growing member base of 5.2 million as of Q4 2023 reflect strong customer loyalty and trust, which are essential for attracting new customers and retaining existing ones.

Regulatory licenses and compliance framework: SoFi’s national bank charter, obtained in 2022, along with its robust compliance infrastructure, constitute key resources that enable the company to operate across various financial services sectors; these assets provide SoFi with increased operational flexibility and potential cost savings in funding its lending activities.

Key Partners – SoFi Business Model Canvas

Financial institutions: SoFi collaborates with various banks and credit unions, such as its partnership with Bancorp Bank for SoFi Money accounts before obtaining its bank charter; these relationships enable SoFi to offer FDIC-insured accounts and expand its financial product range, enhancing its competitiveness in the banking sector.

Technology providers: Strategic partnerships with companies like Coinbase for cryptocurrency services and Mastercard for the SoFi Credit Card are crucial; these collaborations allow SoFi to leverage specialized technologies and networks, thereby expanding its service offerings without developing all capabilities in-house.

Educational institutions: SoFi maintains partnerships with numerous universities and alumni associations, which serve as valuable channels for customer acquisition, particularly for student loan refinancing; for instance, their collaboration with over 500 universities has contributed significantly to their education loan portfolio growth.

Employer partnerships: Through the SoFi at Work program, the company partners with employers to offer financial wellness benefits to employees; this B2B2C model, which has grown to include over 1,000 participating companies by 2023, provides SoFi with a steady stream of potential customers and enhances its brand presence in the workplace.

Sports and entertainment entities: SoFi’s high-profile partnership with SoFi Stadium in Los Angeles, secured through a 20-year naming rights deal worth over $30 million annually, serves as a key marketing tool; additionally, collaborations with sports teams and events provide unique branding opportunities and access to diverse customer segments.

Cost Structure – SoFi Business Model Canvas

Technology and development expenses: SoFi invests heavily in its technological infrastructure, with technology and product development costs reaching $354 million in 2023, representing a significant portion of operating expenses; this investment is crucial for maintaining competitive advantage and supporting the company’s rapid growth across various financial service offerings.

Marketing and customer acquisition costs: To fuel its growth, SoFi allocates substantial resources to marketing and member acquisition, with sales and marketing expenses totaling $533 million in 2023; while this represents a considerable outlay, the company’s efficient digital marketing strategies have helped reduce customer acquisition costs over time.

Interest expense: As a lender and deposit-taking institution, SoFi incurs interest expenses on borrowed funds and customer deposits; in 2023, the company reported $361 million in interest expense, which, although substantial, is partially offset by the interest income generated from its loan portfolio and investments.

Operational and administrative costs: SoFi’s operational expenses, including employee salaries, customer support, and general administrative costs, amounted to $861 million in 2023; this figure reflects the company’s expansion and the costs associated with maintaining its growing member base and diverse product offerings.

Regulatory compliance and risk management: While not explicitly broken out in financial reports, the costs associated with maintaining regulatory compliance and managing risk are significant for SoFi; these expenses, which include legal fees, compliance staff, and sophisticated risk management systems, are essential for operating in the highly regulated financial services industry.

Summary of SoFi Business Model Canvas

Conclusion on SoFi Business Model Canvas

SoFi’s business model canvas reveals a dynamic fintech company that has successfully disrupted traditional financial services. By leveraging technology, offering a comprehensive suite of products, and focusing on customer-centric innovation, SoFi has created a robust ecosystem that attracts and retains a growing user base. The company’s strategic partnerships, strong brand, and efficient cost management have positioned it for continued growth. However, SoFi must navigate regulatory challenges and intense competition while balancing expansion with profitability to sustain its momentum in the evolving fintech landscape.

Hi! I am Mohammad Safayet Hossain, pursuing my BBA in Marketing at the Bangladesh University of Professionals. As a business student, I am passionate about learning about various companies and industries and am here to share them with you.