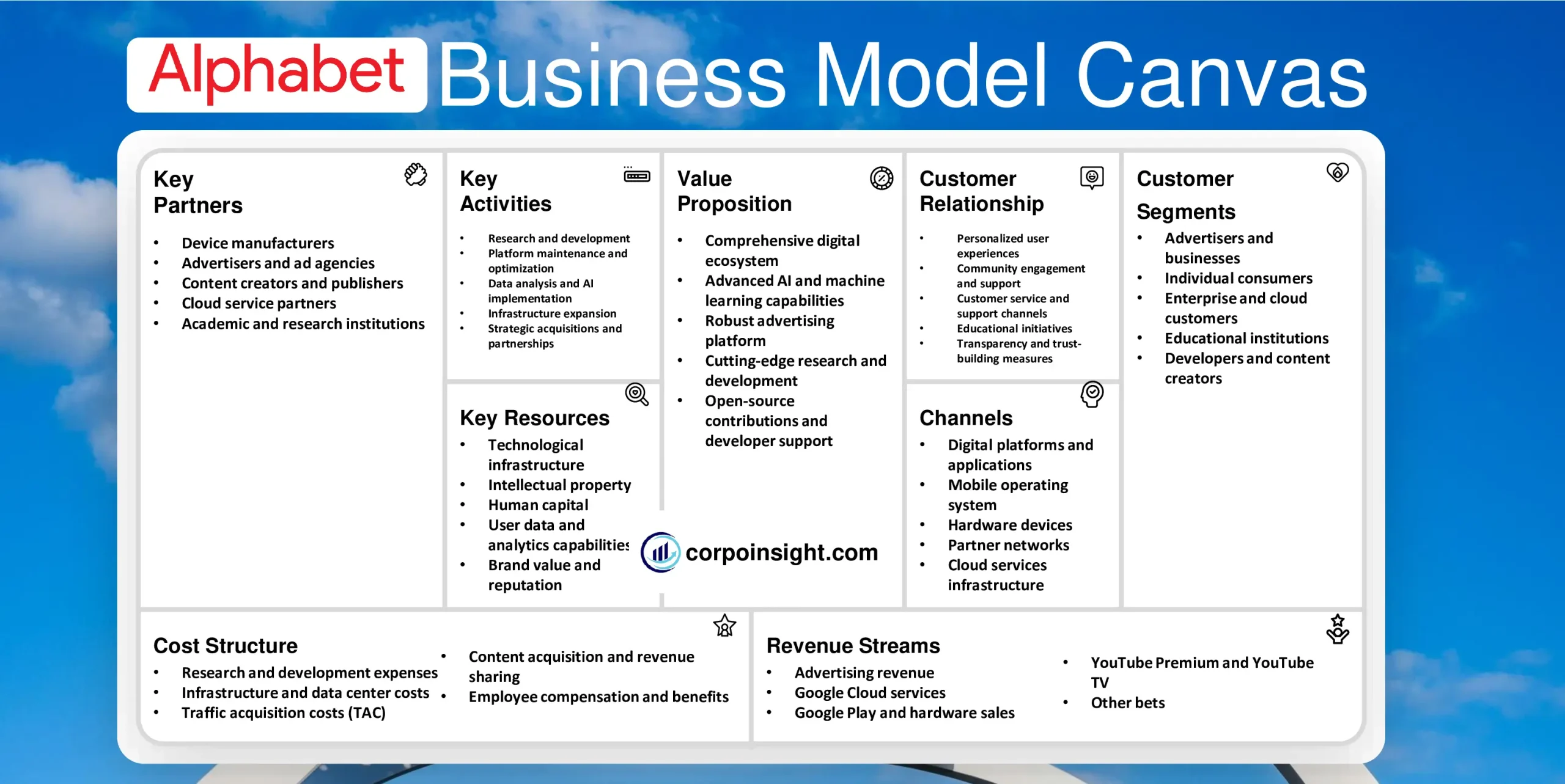

Alphabet Business Model Canvas 2024

While Google’s parent company Alphabet has revolutionized internet search and advertising, its ambitious pursuits in fields ranging from self-driving cars to life extension technology hint at a future far beyond the digital realm. In this Alphabet Business Model Canvas, I will go through its customer segments, value proposition, revenue streams, channels, customer relationships, key activities, key resources, key partners, and cost structure.

Interesting fact!

The company has a secret facility called “X” (formerly Google X) dedicated to developing “moonshot” technologies like self-driving cars and internet-beaming balloons.

Alphabet Competitors

Apple | Microsoft | Amazon | Meta (Facebook) | Alibaba | Tencent | IBM | Oracle | Samsung | Baidu

Customer Segments – Alphabet Business Model Canvas

Advertisers and businesses: Alphabet’s primary revenue source stems from Google Ads, attracting a diverse range of advertisers from small local businesses to multinational corporations. In 2023, Google’s advertising revenue reached $224.47 billion, showcasing the platform’s enduring appeal to businesses seeking digital marketing solutions.

Individual consumers: Through various products like Android, Gmail, and Google Search, Alphabet caters to billions of individual users worldwide. As of 2024, Android holds a 70% global market share in mobile operating systems, while Gmail boasts over 1.8 billion active users, demonstrating the company’s massive consumer reach.

Enterprise and cloud customers: Google Cloud Platform serves businesses and organizations seeking cloud computing and data analytics solutions. In Q4 2023, Google Cloud revenue grew 26% year-over-year to $9.2 billion, indicating strong adoption among enterprise clients across various industries.

Educational institutions: Google Workspace for Education, formerly G Suite for Education, is widely adopted by schools and universities globally. As of 2024, over 170 million students and educators use Google Workspace for Education, highlighting Alphabet’s significant presence in the educational sector.

Developers and content creators: Through platforms like Google Play Store and YouTube, Alphabet engages app developers and content creators. In 2023, Google Play developers earned over $40 billion, while YouTube had 2.5 million monetizing creators in its Partner Program, showcasing the company’s role in supporting digital ecosystems.

Value Proposition – Alphabet Business Model Canvas

Comprehensive digital ecosystem: Alphabet offers a seamlessly integrated suite of products and services, including search, email, cloud storage, and productivity tools, which not only enhance user experience but also increase efficiency across personal and professional domains; for instance, Google Workspace now serves over 3 billion users globally.

Advanced AI and machine learning capabilities: Through continuous innovation in artificial intelligence, Alphabet enhances its products and services, as evidenced by the recent integration of the advanced AI model Gemini into various Google offerings, thereby providing users with more intuitive and personalized experiences across its platforms.

Robust advertising platform: Google Ads remains a cornerstone of Alphabet’s value proposition, offering businesses unparalleled reach and targeting capabilities; in 2023, Google’s advertising revenue reached $224.47 billion, underscoring its effectiveness and appeal to advertisers of all sizes.

Cutting-edge research and development: Alphabet’s commitment to groundbreaking technologies is exemplified by initiatives like Waymo (autonomous vehicles) and Verily (life sciences), which not only push the boundaries of innovation but also position the company at the forefront of future tech trends.

Open-source contributions and developer support: By maintaining popular open-source projects like Android and TensorFlow, Alphabet fosters a thriving developer ecosystem; Android, for instance, powers over 3 billion active devices worldwide, demonstrating the company’s significant impact on the global tech landscape.

Revenue Streams – Alphabet Business Model Canvas

Advertising revenue: Google’s advertising platforms, including Google Search, YouTube, and Google Network, constitute the majority of Alphabet’s income; in 2023, advertising revenue reached $224.47 billion, accounting for approximately 77% of Alphabet’s total revenue, demonstrating the continued dominance of this stream.

Google Cloud services: As businesses increasingly adopt cloud computing solutions, Google Cloud has become a significant revenue source; in 2023, Google Cloud generated $29.48 billion in revenue, marking a 26% year-over-year growth and highlighting its growing importance in Alphabet’s financial portfolio.

Google Play and hardware sales: Revenue from Google Play, including app sales and in-app purchases, combined with hardware sales such as Pixel phones and Nest smart home devices, contributes substantially to Alphabet’s “Google other” category, which generated $29.87 billion in 2023.

YouTube Premium and YouTube TV: Subscription-based services like YouTube Premium and YouTube TV have seen notable growth; while specific figures are not disclosed, these services fall under the “Google other” category and contribute to its increasing revenue share.

Other bets: Alphabet’s innovative ventures, including Waymo (self-driving technology) and Verily (life sciences), represent potential future revenue streams; although currently generating modest revenue ($1.07 billion in 2023), these projects showcase Alphabet’s commitment to diversifying its income sources and exploring new markets.

Channels – Alphabet Business Model Canvas

Digital platforms and applications: Alphabet’s primary channel is its vast array of digital platforms, including Google Search, YouTube, and the Google Play Store, which collectively reach billions of users daily; for instance, Google processes over 8.5 billion searches per day, while YouTube boasts over 2.7 billion monthly active users.

Mobile operating system: Android, Alphabet’s mobile operating system, serves as a crucial channel for distributing Google services and apps; as of 2024, Android powers approximately 70% of global smartphones, providing Alphabet with an unparalleled reach to mobile users worldwide.

Hardware devices: Google-branded devices, such as Pixel smartphones, Nest smart home products, and Chromebooks, act as physical channels for Alphabet’s services; while specific sales figures are not disclosed, these devices play a significant role in expanding the company’s ecosystem and user engagement.

Partner networks: Alphabet leverages partnerships with device manufacturers, telecom providers, and content creators to extend its reach; for example, Google’s partnerships with smartphone manufacturers ensure the pre-installation of Google apps on millions of devices, enhancing user accessibility.

Cloud services infrastructure: Google Cloud Platform serves as a critical channel for enterprise customers, offering cloud computing, data storage, and AI services; with over 150 network edge locations globally, this infrastructure enables Alphabet to deliver fast, reliable services to businesses and developers worldwide.

Customer Relationships – Alphabet Business Model Canvas

Personalized user experiences: Alphabet leverages AI and machine learning to tailor services to individual users, enhancing engagement and loyalty; for instance, Google’s personalized search results and YouTube’s recommendation algorithm, which drives 70% of watch time, demonstrate the company’s commitment to user-centric experiences.

Community engagement and support: Through platforms like Google Developer Communities and YouTube Creator Academy, Alphabet fosters vibrant ecosystems of developers and content creators; as of 2024, there are over 1,000 Google Developer Groups worldwide, facilitating knowledge sharing and relationship building among users and the company.

Customer service and support channels: Alphabet maintains various support channels, including help centers, community forums, and direct customer service for enterprise clients; Google Cloud, for example, offers 24/7 support for its enterprise customers, with a reported customer satisfaction rate of over 90% in recent surveys.

Educational initiatives: By offering free courses and certifications through platforms like Google Digital Garage and Google Career Certificates, Alphabet builds goodwill and long-term relationships with users; since its launch, over 1 million people have completed Google Career Certificate programs, enhancing their digital skills and employability.

Transparency and trust-building measures: Alphabet regularly publishes transparency reports and engages in initiatives to protect user privacy and security; for example, Google’s Advanced Protection Program, which safeguards high-risk users, and its regular security updates for Android devices, underscore the company’s commitment to maintaining user trust.

Key Activities – Alphabet Business Model Canvas

Research and development: Alphabet invests heavily in R&D across various fields, from AI to quantum computing; in 2023, the company spent $39.5 billion on R&D, representing 12.5% of its revenue, which has led to breakthrough technologies like the Gemini AI model and advancements in quantum supremacy.

Platform maintenance and optimization: Continuously improving and maintaining its core platforms, such as Google Search and YouTube, is crucial for Alphabet; for instance, Google makes thousands of search algorithm updates annually, with major ones like the helpful content update in 2023 significantly impacting search results quality.

Data analysis and AI implementation: Leveraging its vast data resources, Alphabet refines its AI capabilities to enhance products and services; the implementation of AI in Google Cloud has led to a 26% year-over-year revenue growth in 2023, reaching $29.48 billion.

Infrastructure expansion: Alphabet consistently expands its global network of data centers and edge locations to support its services; as of 2024, Google Cloud operates in 35 regions worldwide, with plans to add new regions in Mexico, Thailand, and New Zealand.

Strategic acquisitions and partnerships: To broaden its capabilities and market reach, Alphabet engages in strategic acquisitions and partnerships; for example, the $5.4 billion acquisition of Mandiant in 2022 significantly bolstered Google Cloud’s cybersecurity offerings, enhancing its competitiveness in the enterprise market.

Key Resources – Alphabet Business Model Canvas

Technological infrastructure: Alphabet’s vast network of data centers and servers forms the backbone of its operations; as of 2024, Google operates over 23 data center locations globally, with plans to invest $9.5 billion in U.S. offices and data centers, ensuring robust performance and reliability for its services.

Intellectual property: With a diverse portfolio of patents and proprietary algorithms, Alphabet maintains its competitive edge; in 2023, Google was granted 2,942 patents, ranking it among the top 10 U.S. patent recipients and underscoring its commitment to innovation across various technological domains.

Human capital: Alphabet’s workforce of highly skilled engineers, researchers, and innovators drives its success; as of 2023, the company employed approximately 182,000 people worldwide, with a significant portion dedicated to research and development activities.

User data and analytics capabilities: The extensive user data collected across Alphabet’s platforms, combined with advanced analytics tools, enables the company to refine its services and target advertising effectively; Google processes over 8.5 billion searches daily, generating invaluable insights.

Brand value and reputation: Alphabet’s strong brand portfolio, particularly Google, is a key intangible asset; in 2023, Google ranked as the third most valuable brand globally by Brand Finance, with an estimated brand value of $337.5 billion, facilitating user trust and market influence.

Key Partners – Alphabet Business Model Canvas

Device manufacturers: Alphabet collaborates with numerous smartphone and hardware manufacturers to ensure wide distribution of Android and Google services; for instance, Samsung, which holds approximately 20% of the global smartphone market share in 2024, remains a crucial partner in expanding Android’s reach.

Advertisers and ad agencies: As advertising generates the majority of Alphabet’s revenue, relationships with advertisers are vital; in 2023, Google’s advertising revenue reached $224.47 billion, with partnerships ranging from small businesses to global advertising conglomerates like WPP and Omnicom.

Content creators and publishers: YouTube’s partnership with content creators and Google’s collaboration with news publishers are essential for content generation and distribution; as of 2024, YouTube has over 2.5 million monetizing creators in its Partner Program, while Google News Showcase has partnered with over 1,000 news publications globally.

Cloud service partners: To enhance its Google Cloud offerings, Alphabet maintains strategic partnerships with software and service providers; for example, the partnership with SAP, announced in 2017 and expanded in 2023, allows Google Cloud to offer integrated solutions to enterprise customers, contributing to its growing market share.

Academic and research institutions: Collaborations with universities and research centers fuel Alphabet’s innovation pipeline; for instance, the company’s partnership with Stanford University on the AI Index report and its numerous research grants to academic institutions worldwide contribute to advancements in AI and other cutting-edge technologies.

Cost Structure – Alphabet Business Model Canvas

Research and development expenses: Alphabet heavily invests in R&D to maintain its competitive edge; in 2023, the company spent $39.5 billion on R&D, representing 12.5% of its revenue, which encompasses projects ranging from AI advancements to moonshot technologies in Alphabet’s X division.

Infrastructure and data center costs: Maintaining and expanding Alphabet’s vast network of data centers and technological infrastructure constitutes a significant expense; while specific figures are not disclosed, the company’s ongoing investments, such as the $9.5 billion earmarked for U.S. offices and data centers in 2022, highlight the magnitude of these costs.

Traffic acquisition costs (TAC): Alphabet incurs substantial expenses to acquire traffic and distribute its services; in 2023, TAC amounted to $43.25 billion, which includes payments to distribution partners and Apple for featuring Google as the default search engine on iOS devices.

Content acquisition and revenue sharing: For platforms like YouTube, content-related costs are considerable; while exact figures are not public, YouTube’s revenue sharing model, where creators typically receive 55% of ad revenue, represents a significant ongoing expense for Alphabet.

Employee compensation and benefits: As a technology-driven company, Alphabet’s workforce is a crucial asset and a major cost center; in 2023, the company reported $52.8 billion in employee compensation expenses, reflecting the high costs associated with attracting and retaining top talent in the competitive tech industry.

Summary of Alphabet Business Model Canvas

Conclusion on Alphabet Business Model Canvas

Alphabet’s business model canvas reveals a tech giant with a diverse ecosystem of products and services, anchored by its dominant advertising platform. The company leverages its vast user base, cutting-edge technology, and robust infrastructure to drive innovation across multiple sectors. While facing challenges in privacy concerns and regulatory scrutiny, Alphabet’s strategic investments in AI, cloud computing, and emerging technologies position it for continued growth and influence in the digital landscape. Its ability to balance core revenue streams with ambitious “moonshot” projects underscores a forward-thinking approach to sustainable business expansion.

I’m Samin Yasar, currently working as a Brand Strategist for one of the world’s leading Prop Firms. I have a passion for content creation and dream of making my own film one day.