Redfin Business Model Canvas 2025: Tech-Driven Market Evolution

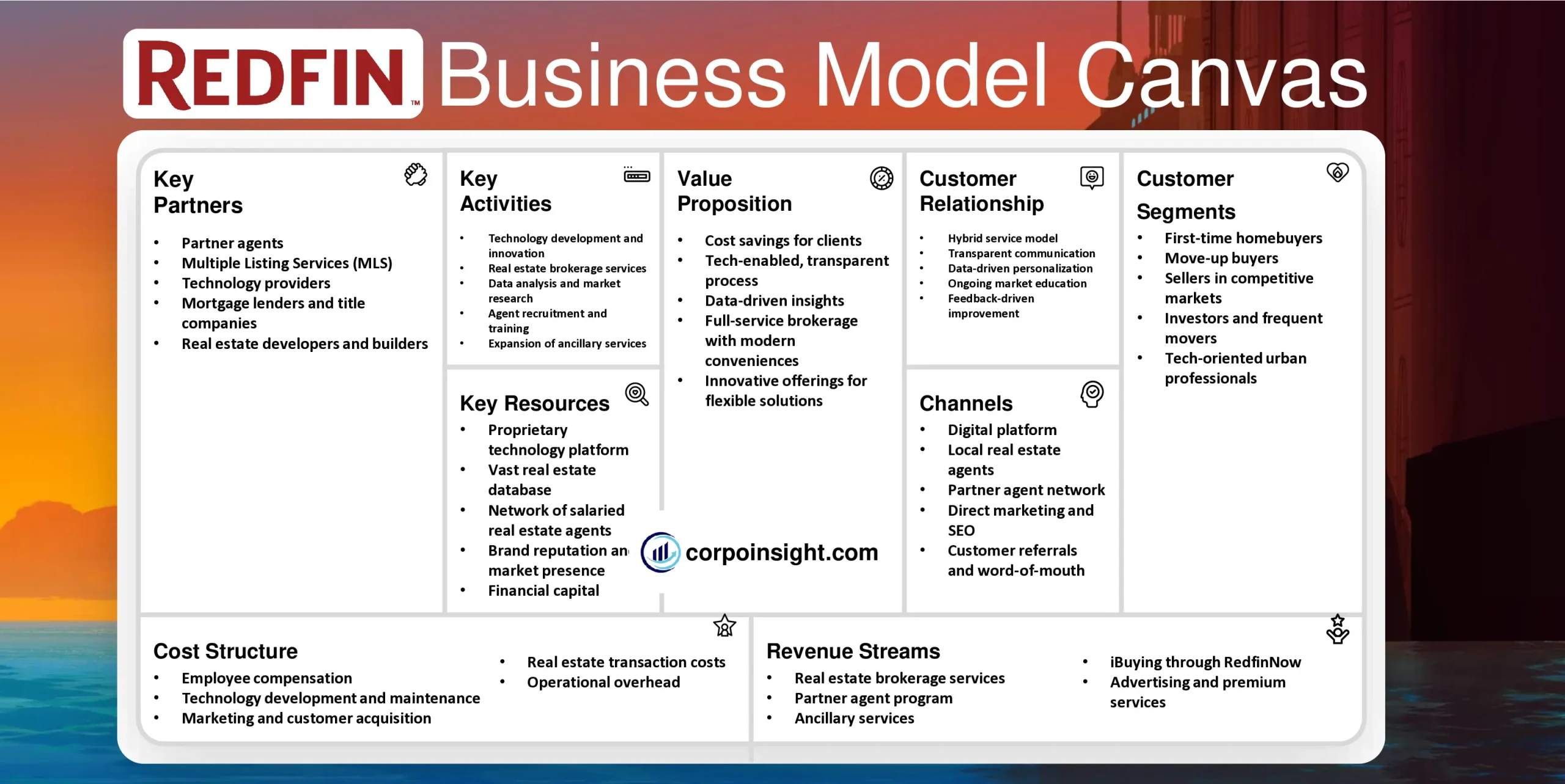

While Redfin revolutionized the real estate industry with its tech-driven approach and reduced commission model, it continues to face challenges in a highly competitive and cyclical housing market. In this Redfin business model canvas, I will identify its customer segments, value proposition, revenue streams, channels, customer relationships, key activities, key resources, key partners, and cost structure.

Interesting fact!

Redfin has a unique “Comedy Caucus” – a group of employees who meet regularly to write jokes and create humorous content for company-wide meetings and events.

Redfin Competitors

Zillow | Realtor.com | Compass | Opendoor | Keller Williams | RE/MAX | Century 21 | Coldwell Banker | eXp Realty | HomeLight

Customer Segments – Redfin Business Model Canvas

First-time homebuyers: Redfin’s user-friendly platform and cost-saving model particularly appeal to millennials and Gen Z entering the housing market; these tech-savvy groups, often burdened with student debt, are drawn to Redfin’s lower fees and digital-first approach.

Move-up buyers: As families expand or careers advance, this segment seeks larger homes or more desirable neighborhoods; Redfin’s comprehensive listings and neighborhood insights cater to their specific needs, while the potential savings on commissions can be significant on higher-priced properties.

Sellers in competitive markets: In hot real estate markets where properties sell quickly, homeowners increasingly turn to Redfin’s lower listing fees to maximize their profits; the company’s tech-enabled services, including 3D walkthroughs and professional photography, help these sellers showcase their homes effectively.

Investors and frequent movers: Real estate investors and those who often relocate for work find value in Redfin’s data-rich platform and potential for repeat savings; the company’s expansion into iBuying with RedfinNow (where available) offers an additional quick-sale option that appeals to this segment.

Tech-oriented urban professionals: This group, typically working in STEM fields and residing in major tech hubs, aligns with Redfin’s data-driven approach; they appreciate the transparency, online tools, and the ability to handle much of the process digitally, making Redfin a natural fit for their real estate needs.

Value Proposition – Redfin Business Model Canvas

Cost savings for clients: Redfin’s innovative model, which combines technology with salaried agents, allows them to offer significantly reduced commissions—typically 1% for sellers when they also buy with Redfin, compared to the traditional 2.5-3% listing fee—potentially saving clients thousands of dollars on each transaction.

Tech-enabled, transparent process: By leveraging cutting-edge technology, including their user-friendly website and mobile app, Redfin provides clients with real-time updates, on-demand tours, and comprehensive property insights; this transparency and accessibility streamline the often complex real estate process, empowering clients to make informed decisions quickly.

Data-driven insights: Redfin’s vast database and proprietary algorithms offer clients access to in-depth market analyses, accurate home value estimates, and neighborhood statistics; this wealth of information, combined with local agent expertise, enables buyers and sellers to navigate the market more effectively and confidently.

Full-service brokerage with modern conveniences: While Redfin offers significant cost savings, they maintain a full-service model that includes professional photography, 3D walkthroughs, and targeted digital marketing campaigns; additionally, their on-demand tour scheduling and digital document signing cater to the preferences of today’s tech-savvy consumers.

Innovative offerings for flexible solutions: Redfin continually expands its services to meet diverse client needs, including RedfinNow for instant home purchases in select markets, Redfin Concierge for premium listing services, and Redfin Mortgage for streamlined home financing; these integrated offerings provide clients with a comprehensive, one-stop solution for their real estate transactions.

Revenue Streams – Redfin Business Model Canvas

Real estate brokerage services: The core of Redfin’s revenue comes from its brokerage services, where they typically charge a 1% listing fee (or 1.5% if the seller doesn’t also buy with Redfin), significantly lower than traditional brokerages; this competitive pricing, combined with their tech-enabled service, has helped Redfin capture market share and generate substantial revenue.

Partner agent program: In areas where Redfin’s coverage is limited, they refer clients to partner agents and earn a referral fee, typically 30% of the partner agent’s commission; this program allows Redfin to monetize leads in markets where they don’t have a direct presence, contributing to their revenue without the overhead of full operations.

Ancillary services: Redfin has diversified its revenue streams by offering complementary services such as Redfin Mortgage and title services through Title Forward; these offerings provide additional income and create a more integrated and seamless experience for clients, potentially increasing customer loyalty and repeat business.

iBuying through RedfinNow: Although this service is not available in all markets, RedfinNow generates revenue by purchasing homes directly from sellers and reselling them after minor improvements; while this stream can be more volatile due to market fluctuations, it represents a significant growth opportunity and diversification of Redfin’s business model.

Advertising and premium services: Redfin monetizes its popular website and app through advertising placements and premium services like Redfin Concierge, which offers an enhanced listing package for a higher fee; these additional revenue streams leverage Redfin’s substantial web traffic and brand recognition in the real estate market.

Channels – Redfin Business Model Canvas

Digital platform: Redfin’s website and mobile app serve as primary channels, offering a user-friendly interface where clients can search listings, schedule tours, and access market insights; this digital-first approach, which garnered over 47 million average monthly users in Q4 2022, aligns with modern consumers’ preferences for on-demand information and services.

Local real estate agents: While leveraging technology, Redfin maintains a network of salaried local agents who provide personalized service and expertise; these agents, equipped with Redfin’s proprietary tools, serve as a crucial channel for client interaction, offering in-person support throughout the buying or selling process.

Partner agent network: In areas where Redfin’s direct presence is limited, they utilize a partner agent network to service clients; this channel allows Redfin to expand its reach without the overhead of full market entry, while still maintaining brand presence and generating revenue through referral fees.

Direct marketing and SEO: Redfin invests significantly in digital marketing and search engine optimization to attract potential clients to their platform; by targeting keywords related to home buying, selling, and real estate market trends, Redfin ensures high visibility in organic search results and paid advertising channels.

Customer referrals and word-of-mouth: Satisfied clients often become a powerful channel for Redfin, with the company’s unique value proposition of tech-enabled service and cost savings naturally encouraging word-of-mouth referrals; Redfin further incentivizes this channel through referral programs, offering rewards to clients who refer new customers.

Customer Relationships – Redfin Business Model Canvas

Hybrid service model: Redfin’s unique approach combines digital tools with human expertise, offering clients the convenience of online resources alongside personalized support from local agents; this hybrid model, which has contributed to Redfin’s market share growth to 0.85% of U.S. existing home sales in Q4 2022, allows for tailored relationships that adapt to each client’s preferences and needs.

Transparent communication: Through their digital platform, Redfin provides real-time updates, offer insights, and transaction timelines, fostering trust and reducing anxiety in the often stressful real estate process; this commitment to transparency, coupled with their “no pressure” approach, has contributed to Redfin’s high customer satisfaction rates and repeat business.

Data-driven personalization: Leveraging advanced analytics and machine learning, Redfin tailors property recommendations and market insights to individual client preferences; this personalized approach, evident in features like their customizable feed of new listings, enhances the customer experience and strengthens long-term relationships with the platform.

Ongoing market education: Redfin maintains relationships with clients beyond individual transactions by providing valuable, ongoing market insights through their blog, newsletters, and regular market reports; this continuous engagement keeps Redfin top-of-mind for future real estate needs and positions the company as a trusted advisor in the industry.

Feedback-driven improvement: Redfin actively solicits and responds to customer feedback, using this input to refine its services and digital tools continuously; its commitment to improvement is reflected in its high Net Promoter Score, which has consistently outperformed traditional brokerages, demonstrating strong customer loyalty and satisfaction.

Key Activities – Redfin Business Model Canvas

Technology development and innovation: Redfin continually invests in enhancing its digital platform, with recent innovations including AI-powered home recommendations and virtual 3D walkthroughs; these technological advancements, which saw Redfin’s mobile app downloads increase by 30% year-over-year in 2022, are crucial for maintaining their competitive edge in the tech-driven real estate market.

Real estate brokerage services: At the core of Redfin’s operations is their full-service brokerage, where they leverage technology to streamline the buying and selling process; their unique model, which includes salaried agents and reduced commissions, has allowed them to close over 200,000 transactions since inception, demonstrating the scalability and effectiveness of their approach.

Data analysis and market research: Redfin’s team of data scientists and economists continuously analyze vast amounts of real estate data to provide accurate market insights and forecasts; this activity not only enhances their service offerings but also positions Redfin as a thought leader in the industry, with their reports frequently cited in major media outlets.

Agent recruitment and training: To maintain their high service standards while scaling operations, Redfin invests heavily in recruiting and training top-tier real estate agents; their comprehensive training program, which combines traditional real estate knowledge with proficiency in Redfin’s proprietary tools, ensures consistency in service quality across markets.

Expansion of ancillary services: Redfin actively develops and integrates complementary services such as mortgage lending, title services, and iBuying; these activities, which saw Redfin Mortgage’s revenue grow by 14% year-over-year in Q4 2022, are key to creating a more comprehensive and seamless real estate experience for clients while diversifying Redfin’s revenue streams.

Key Resources – Redfin Business Model Canvas

Proprietary technology platform: Redfin’s custom-built technology stack, including its website and mobile app, serves as a critical resource that differentiates the company from traditional brokerages; this platform, which handled over 47 million average monthly users in Q4 2022, enables efficient property searches, tour scheduling, and transaction management, forming the backbone of Redfin’s operations.

Vast real estate database: Redfin’s extensive database of property listings, historical sales data, and market trends serves as a valuable resource for both the company and its clients; this comprehensive dataset, which is continuously updated and analyzed, powers Redfin’s accurate home value estimates and market forecasts, enhancing their credibility in the industry.

Network of salaried real estate agents: Unlike traditional brokerages, Redfin employs a network of salaried agents who are equipped with the company’s proprietary tools and technology; this unique workforce model, which included over 2,000 lead agents as of 2022, allows Redfin to maintain consistent service quality and align agent incentives with customer satisfaction.

Brand reputation and market presence: Redfin’s established brand, known for innovation and cost savings, represents a significant intangible resource; its market presence, which has grown to cover more than 95 markets across the United States and Canada, provides a strong foundation for continued expansion and customer acquisition.

Financial capital: With a solid financial position, including $475 million in cash and cash equivalents as of Q4 2022, Redfin possesses the resources to invest in technology development, market expansion, and strategic initiatives; this financial stability allows the company to weather market fluctuations and pursue long-term growth strategies in the competitive real estate industry.

Key Partners – Redfin Business Model Canvas

Partner agents: In markets where Redfin’s direct presence is limited, they collaborate with a network of independent partner agents; this partnership, which allows Redfin to serve clients in areas without full-time staff, has expanded their effective reach to over 95% of the U.S. population, significantly enhancing their market coverage without the overhead of direct expansion.

Multiple Listing Services (MLS): Redfin’s partnerships with various MLS organizations across the country are crucial for accessing comprehensive, up-to-date property listings; these collaborations, which require adherence to specific data usage agreements, enable Redfin to provide accurate and timely information to their clients, forming the foundation of their property search capabilities.

Technology providers: To enhance their digital offerings, Redfin partners with various technology companies for services such as virtual tour platforms, digital signature solutions, and cloud infrastructure; these partnerships, while not always publicly disclosed, are essential for maintaining Redfin’s competitive edge in the tech-driven real estate market.

Mortgage lenders and title companies: In addition to their in-house Redfin Mortgage service, the company maintains partnerships with external mortgage lenders and title companies to offer clients a range of financing options; these relationships, which complement Redfin’s core services, contribute to a more comprehensive and seamless home buying experience for their customers.

Real estate developers and builders: Redfin collaborates with real estate developers and builders to list new construction properties on their platform; these partnerships, which have become increasingly important as Redfin expands its new construction offerings, provide clients with access to a broader range of housing options and represent a growing segment of Redfin’s business.

Cost Structure – Redfin Business Model Canvas

Employee compensation: As Redfin operates on a model of salaried agents rather than commission-based, employee compensation forms a significant portion of their cost structure; this includes not only salaries for real estate agents but also for their substantial technology and support staff, which, according to their 2022 annual report, accounted for approximately 70% of their total operating expenses.

Technology development and maintenance: Redfin invests heavily in developing and maintaining its proprietary technology platform, which is crucial for its competitive advantage; these costs, which include software development, cloud infrastructure, and cybersecurity measures, are substantial but necessary for Redfin to maintain its position as a tech-forward real estate company.

Marketing and customer acquisition: To drive growth and maintain market share, Redfin allocates significant resources to marketing and customer acquisition efforts; these expenses, which include digital advertising, search engine optimization, and brand-building initiatives, are essential for attracting new clients in the highly competitive real estate market.

Real estate transaction costs: Despite their innovative model, Redfin still incurs traditional real estate transaction costs, including MLS fees, property marketing expenses, and closing costs for their iBuying operations; these transaction-related expenses, while variable, form a notable part of their cost structure, particularly as they expand their iBuying services.

Operational overhead: Redfin maintains physical offices in many markets to support their local agents and provide a base for operations; these overhead costs, which include office leases, utilities, and administrative expenses, contribute to their fixed cost structure and can impact profitability, especially in slower market conditions or during expansion into new territories.

Summary of Redfin Business Model Canvas

Conclusion on Redfin Business Model Canvas

Redfin’s business model canvas reveals a tech-driven, customer-centric approach to real estate that challenges traditional norms. By leveraging proprietary technology, data analytics, and a unique salaried agent model, Redfin offers cost savings and transparency to clients while maintaining full-service capabilities. Their diversified revenue streams, including brokerage services, mortgage lending, and iBuying, coupled with strategic partnerships and ongoing innovation, position Redfin as a disruptive force in the real estate industry, poised for continued growth despite market fluctuations.

Majoring in marketing from Bangladesh University of Professionals, Sadman Abrar is a learner, obsessed with branding and intrigued to learn about different company strategies, and currently working at bKash.