Affirm Business Model Canvas 2024

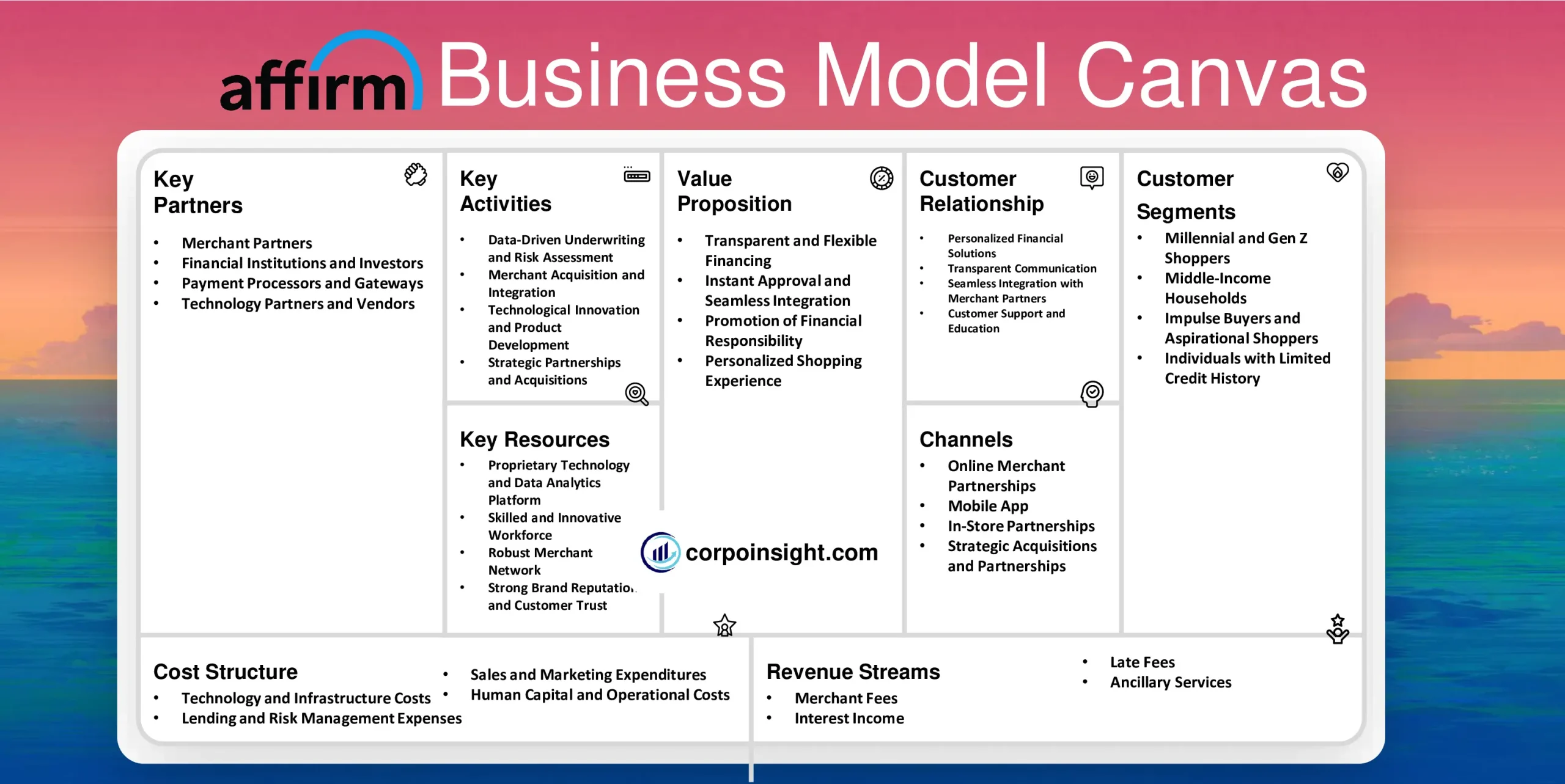

Despite being a relatively new player in the fintech space, founded in 2012, Affirm has swiftly risen to prominence by pioneering a transparent and flexible “buy now, pay later” model that allows consumers to split purchases into instalment loans sans the hidden fees and revolving balances typical of traditional credit cards. In this Affirm business model canvas, I will identify its customer segments, value proposition, revenue streams, channels, customer relationships, key activities, key resources, key partners, and cost structure.

Interesting fact!

Max Levchin, Affirm’s CEO, has a quirky tradition of naming all the meeting rooms at their offices after declined or successful patent applications he’s filed.

Affirm Competitors

Afterpay | Klarna | Sezzle | Zip | Openpay | ViaBill | Perpay | Quadpay | Splitit | Paypal Credit

Customer Segments – Affirm Business Model Canvas

1. Millennial and Gen Z Shoppers: Affirm’s primary target audience comprises tech-savvy millennials and Gen Z consumers, who not only embrace digital payments but also seek greater transparency and flexibility in financing options, which aligns perfectly with Affirm’s value proposition.

2. Middle-Income Households: With an average order value ranging from $500 to $1,000, Affirm caters to middle-income households seeking affordable financing solutions for larger purchases, such as home furnishings, electronics, or travel expenses.

3. Impulse Buyers and Aspirational Shoppers: By offering interest-free installment plans for specific durations, Affirm appeals to impulse buyers and aspirational shoppers who desire instant gratification without the burden of upfront costs or exorbitant interest rates.

4. Individuals with Limited Credit History: Affirm’s underwriting process, which considers factors beyond traditional credit scores, has attracted individuals with limited or poor credit histories who may have difficulty securing financing through conventional lenders.

Value Proposition – Affirm Business Model Canvas

1. Transparent and Flexible Financing: Affirm’s core value proposition lies in its transparent and flexible financing model, which empowers consumers with clear terms, interest rates, and repayment schedules, eliminating the ambiguity and potential for hidden fees associated with traditional credit cards.

2. Instant Approval and Seamless Integration: Leveraging advanced data analytics and machine learning algorithms, Affirm offers instant approval decisions and seamlessly integrates its financing solutions into merchants’ checkout processes, providing a frictionless and convenient experience for customers.

3. Promotion of Financial Responsibility: By offering fixed installment loans with predetermined repayment schedules, Affirm encourages financial responsibility and helps consumers avoid the debt trap associated with revolving credit, thereby fostering a healthier relationship with credit.

4. Personalized Shopping Experience: Affirm’s ability to tailor financing options based on individual customer profiles and purchase amounts enhances the overall shopping experience, catering to varying financial situations and preferences while promoting greater accessibility to desired products and services.

Revenue Streams – Affirm Business Model Canvas

1. Merchant Fees: Affirm’s primary revenue stream stems from the fees charged to its merchant partners, typically ranging from 6% to 8% of the total transaction value, which merchants willingly pay in exchange for increased sales and the ability to offer flexible financing options to their customers.

2. Interest Income: By extending installment loans to consumers, Affirm generates interest income, calculated as a simple interest rate applied to the outstanding loan balance, which varies based on factors such as the customer’s creditworthiness and the loan duration.

3. Late Fees: While Affirm prides itself on its transparency and lack of hidden fees, it does charge late fees to customers who miss their scheduled installment payments, generating an additional revenue stream while incentivizing timely repayment.

4. Ancillary Services: Affirm has recently begun exploring additional revenue streams by offering ancillary services, such as extended warranties and product protection plans, to its customers during the checkout process, enabling merchants to cross-sell complementary products and services.

Channels – Affirm Business Model Canvas

1. Online Merchant Partnerships: Affirm’s primary channel is its integration with online merchants’ checkout processes, enabling customers to seamlessly select Affirm’s financing options during their online shopping journey, thereby facilitating impulse purchases and enhancing conversion rates for its merchant partners.

2. Mobile App: Acknowledging the growing importance of mobile commerce, Affirm has developed a user-friendly mobile app that allows customers to manage their installment loans, make payments, and explore new financing opportunities, fostering a seamless and convenient experience across devices.

3. In-Store Partnerships: While initially focused on e-commerce, Affirm has expanded its reach to physical retail stores, partnering with major brands and retailers to offer its financing solutions at the point of sale, catering to customers who prefer a more traditional shopping experience.

4. Strategic Acquisitions and Partnerships: Affirm has actively pursued strategic acquisitions and partnerships with complementary fintech companies and payment processors, such as Resolve and PayBright, to expand its geographical footprint, enhance its technological capabilities, and broaden its reach within the rapidly evolving fintech landscape.

Customer Relationships – Affirm Business Model Canvas

1. Personalized Financial Solutions: By utilizing advanced data analytics and machine learning algorithms, Affirm tailors its financing solutions to individual customer profiles, fostering a personalized experience that caters to varying financial situations, preferences, and risk profiles.

2. Transparent Communication: Affirm’s commitment to transparency extends beyond its product offerings to its communication strategies, providing customers with clear and concise information regarding interest rates, repayment schedules, and terms and conditions, thus building trust and promoting long-term loyalty.

3. Seamless Integration with Merchant Partners: Through seamless integration with its merchant partners’ checkout processes, Affirm creates a frictionless customer experience, enabling customers to access flexible financing options without disrupting their shopping journey, thereby enhancing satisfaction and retention.

4. Customer Support and Education: Recognizing the importance of financial literacy, Affirm invests in customer support and educational resources, empowering customers to make informed decisions and better manage their finances, fostering a deeper connection and trust with the brand.

Key Activities – Affirm Business Model Canvas

1. Data-Driven Underwriting and Risk Assessment: Affirm’s core competency lies in its data-driven underwriting and risk assessment processes, which utilize advanced machine learning algorithms and alternative data sources to evaluate creditworthiness, enabling the company to make informed lending decisions and mitigate potential risks.

2. Merchant Acquisition and Integration: Recognizing the importance of a robust merchant network, Affirm actively engages in merchant acquisition strategies, seamlessly integrating its financing solutions into partners’ checkout processes, thereby expanding its reach and enhancing the overall customer experience.

3. Technological Innovation and Product Development: To maintain its competitive edge, Affirm invests significantly in technological innovation and product development, continuously refining its platform, exploring new financing models, and introducing value-added services to meet the evolving needs of consumers and merchants alike.

4. Strategic Partnerships and Acquisitions: With a forward-thinking mindset, Affirm actively pursues strategic partnerships and acquisitions that complement its core offerings, enabling the company to expand its geographical footprint, enhance its technological capabilities, and broaden its reach within the rapidly evolving fintech landscape.

Key Resources – Affirm Business Model Canvas

1. Proprietary Technology and Data Analytics Platform: At the heart of Affirm’s operations lies its proprietary technology platform, which underpins its data-driven underwriting processes, risk assessment models, and seamless integration with merchant partners, providing a significant competitive advantage in the rapidly evolving fintech landscape.

2. Skilled and Innovative Workforce: Affirm’s success is contingent upon its ability to attract and retain a skilled and innovative workforce, comprising talented professionals skilled in areas such as data science, machine learning, software engineering, and financial risk management.

3. Robust Merchant Network: Affirm’s extensive merchant network, spanning diverse industries and verticals, serves as a critical resource, enabling the company to offer its financing solutions to a broad customer base while simultaneously driving revenue growth and customer acquisition.

4. Strong Brand Reputation and Customer Trust: By consistently delivering on its promise of transparency, flexibility, and financial responsibility, Affirm has cultivated a strong brand reputation and garnered substantial customer trust, which serves as an invaluable intangible resource in the highly competitive fintech sector.

Key Partners – Affirm Business Model Canvas

1. Merchant Partners: Affirm’s extensive network of merchant partners, which includes prominent retailers, e-commerce platforms, and service providers across various industries, serves as a pivotal component of its business model, enabling the company to offer its financing solutions to a broad customer base while simultaneously driving revenue growth.

2. Financial Institutions and Investors: To support its lending operations and fuel its growth aspirations, Affirm has forged strategic partnerships with various financial institutions and investors, who provide the necessary capital and funding, thereby ensuring a consistent and reliable stream of financing for its customers.

3. Payment Processors and Gateways: By integrating with leading payment processors and gateways, Affirm ensures a seamless and secure transaction experience for both customers and merchants, facilitating a frictionless checkout process and enabling the efficient processing of payments and settlements.

4. Technology Partners and Vendors: Recognizing the importance of technological innovation, Affirm collaborates with a range of technology partners and vendors, leveraging their expertise in areas such as data analytics, machine learning, and software development to enhance its platform, improve operational efficiency, and stay ahead of the curve in the rapidly evolving fintech landscape.

Cost Structure – Affirm Business Model Canvas

1. Technology and Infrastructure Costs: Affirm’s technology-driven business model necessitates substantial investments in developing and maintaining its proprietary platform, data analytics capabilities, and IT infrastructure, resulting in significant costs associated with software development, cloud computing services, and cybersecurity measures.

2. Lending and Risk Management Expenses: As a lending platform, Affirm incurs substantial costs related to underwriting, risk assessment, and loan servicing, including expenses associated with data acquisition, credit decisioning models, and collections efforts aimed at minimizing defaults and delinquencies.

3. Sales and Marketing Expenditures: To attract new customers and expand its merchant network, Affirm allocates significant resources towards sales and marketing initiatives, encompassing activities such as advertising campaigns, promotional offers, and partnership development efforts with both consumers and merchants.

4. Human Capital and Operational Costs: Affirm’s success hinges on its ability to attract and retain top talent, resulting in substantial costs associated with employee salaries, benefits, and training programs, as well as operational expenses related to office spaces, utilities, and administrative support functions.

Summary of Affirm Business Model Canvas

Conclusion on Affirm Business Model Canvas

In conclusion, Affirm’s innovative business model canvas revolves around its transparent and flexible “buy now, pay later” financing solutions, catering to the evolving preferences of tech-savvy consumers. By leveraging proprietary technology, data-driven underwriting, and strategic partnerships, Affirm has disrupted traditional lending practices, offering a compelling value proposition that fosters financial responsibility while driving growth and profitability in the rapidly evolving fintech landscape.

I’m Samin Yasar, currently working as a Brand Strategist for one of the world’s leading Prop Firms. I have a passion for content creation and dream of making my own film one day.