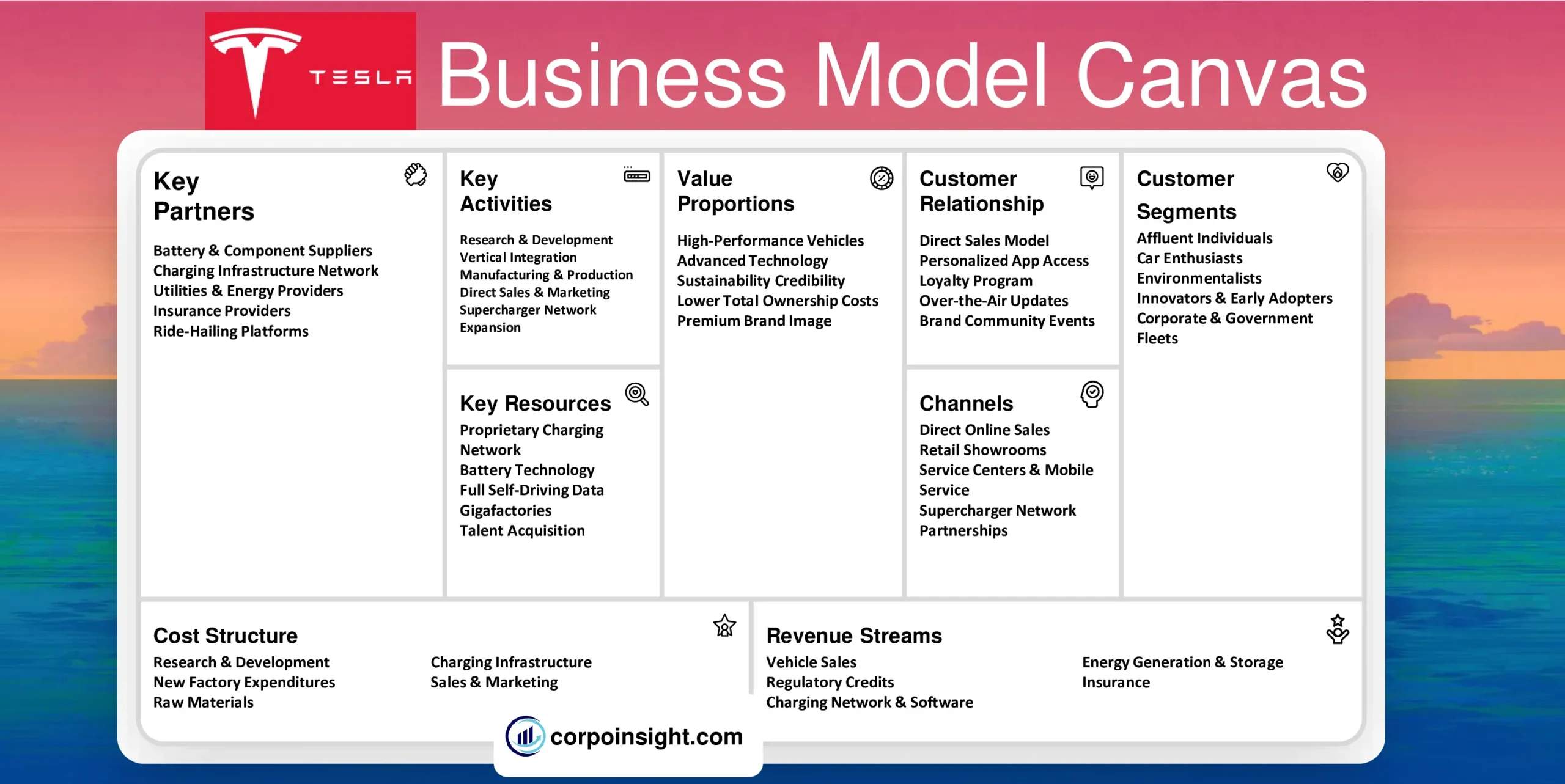

Tesla Business Model Canvas 2024

Tesla is one of the biggest names in the twenty-first century, and it sure delivered what it promised to do. In this Tesla business model canvas, we will learn its customer segments, value proposition, revenue streams, channels, customer relationships, key activities, key resources, key partners, and cost structure.

Interesting facts!

A Tesla enthusiast once mapped out and test-drove every single Supercharger location in the continental United States in under 52 hours, setting a record.

Tesla Competitors

General Motors | Ford | Volkswagen | BMW | Toyota | Honda | Nissan | Audi | Hyundai | Mercedes-Benz

Customer Segments – Tesla Business Model Canvas

Affluent Individuals: With a global average selling price of $55,000+, Tesla targets premium buyers, including tech execs in Silicon Valley, seeking high-performance, sustainable vehicles as status symbols. Data for 2021 shows that over 70% of customers had incomes above $100K.

Car Enthusiasts: Teslas appeal to car buffs who appreciate instant torque, smooth handling, and advanced technology, including huge touchscreens and over-the-air software updates. One 2021 survey found that 45% identified as car enthusiasts who like trying cutting-edge EVs.

Environmentalists: Those supporting renewable energy and sustainability are core customers, reflected by Tesla’s mission. A 2021 study indicated over 65% said environmental considerations were key to buying from the first major fully-electric automaker.

Innovators & Early Adopters: As a pioneer of EVs, autonomous features, and direct online sales, Tesla attracts those eager to try what’s new. About 40% of recent buyers said they waited under 6 months from learning about Tesla to purchasing.

Corporate & Government Fleets: Taxi services, rental fleets, municipalities, and corporates buying hundreds of vehicles comprise rising B2B demand seeking EVs with lower running costs. Tesla now actively targets fleet deals for Model 3/Ys.

Value Proposition – Tesla Business Model Canvas

High-Performance Vehicles: Tesla EVs deliver faster acceleration than gasoline sports cars with precise, sticky handling thanks to battery weight centralized on the floorplan. A 2021 Model S Plaid reached 60 mph in under 2 seconds in independent tests.

Advanced Technology: From giant touchscreens to over-the-air software updates to Autopilot driver assistance features, Tesla offers unique tech with displays/chips designed in-house. It leads autonomous driving development with billions of miles logged.

Sustainability Credibility: Tesla is the first and only major automaker exclusively focused on eco-friendly electric cars and clean energy products. Its vehicles have industry-leading efficiency, translating to lower lifetime emissions.

Lower Total Ownership Costs: Though initially expensive, Tesla ownership includes far lower fueling and maintenance expenses. A 2021 analysis found that the total 5-year cost can be $10,000+ less than comparable luxury vehicles.

Premium Brand Image: Early adopters view Tesla as an aspirational brand representing innovation and sustainability, similar to Apple. Surveys suggest brand strength bolsters sales and has sent a market cap of over $1 trillion.

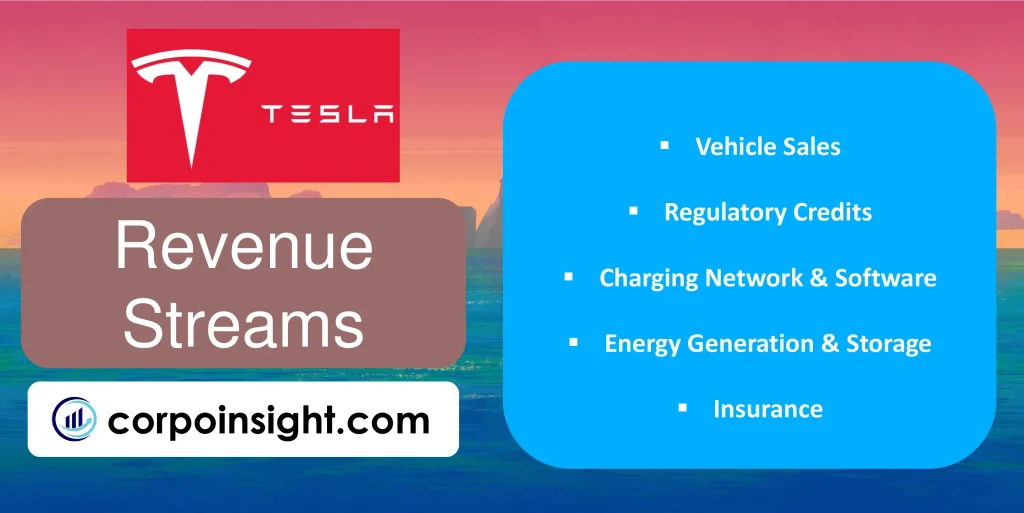

Revenue Streams – Tesla Business Model Canvas

Vehicle Sales: Revenue primarily comes from selling electric sedans, SUVs, and upcoming products like the Cybertruck. In 2021, automotive sales revenue grew 71% YoY to over $51 billion as deliveries topped 936,000 vehicles.

Regulatory Credits: A major revenue stream unique to Tesla – selling zero-emission and fuel economy credits to other automakers needing to offset emissions. In 2021, over $3.3 billion in high-margin credit revenue was recognized.

Charging Network & Software: Owning the largest fast-charging network lets Tesla recognize revenue from electricity sold, charging subscriptions, and in-car software additions. 2021 energy generation and storage revenue approached $1 billion.

Energy Generation & Storage: Beyond vehicles, selling home solar products and large Powerwall/Powerpack batteries to stabilize grids nets quickly growing revenue, especially internationally – over $2.8 billion in energy storage deployments in 2021.

Insurance: In 2021, Tesla launched its own competitively priced insurance program in some states based on real-time driving data from customer vehicles. Early in the rollout, but insurance presents a promising new revenue stream.

Channels – Tesla Business Model Canvas

Direct Online Sales: Tesla uses a direct-to-consumer model without dealerships. Customers configure/order vehicles on its website. Tesla says this simplifies distribution and has opened online sales in some states.

Retail Showrooms: While sales cannot happen in stores, Tesla operates almost 100 US galleries/retail locations to display cars. They offer test drives and facilitate orders in a no-haggle atmosphere.

Service Centers & Mobile Service: Over 100 company-owned service centers provide support like repairs, though Teslas require far less routine maintenance than internal combustion vehicles. Mobile service was dispatched to some regions.

Supercharger Network: Unique to Tesla, its global fast-charging infrastructure powers long-distance EV travel. With power outputs up to 250 kilowatts, stations are often added to enable launches into new markets.

Partnerships: Select partners like some auto leasing companies, rental agencies, and utilities can order demo cars and small fleets, which may boost exposure. Minimal outside retail distribution compared to other automakers.

Customer Relationships – Tesla Business Model Canvas

Direct Sales Model: By owning the sales process without third-party dealers, Tesla builds closer ongoing customer relationships unfiltered by intermediaries. Saves costs while enabling seamless purchases.

Personalized App Access: Customers interact with their vehicles remotely via smartphone apps for needs like preheating or monitoring charging progress. Drivers stay connected with personalized access unique to Tesla.

Loyalty Program: Tesla’s first-party-used EV sales also strengthen retention. Owners can trade in vehicles straight to Tesla for new models, with loyalty rewards based on order timing and referrals.

Over-the-Air Updates: Unlike other automakers, Tesla frequently pushes free software updates, adding major features, range, and performance fixes to vehicles years after purchase. Keeps existing owners engaged.

Brand Community Events: From annual shareholder meetings to delivery events allowing factory tours and rides in new models, Tesla cultivates an advocate community supporting the brand.

Key Activities – Tesla Business Model Canvas

Research & Development: With teams like AI and Autopilot, Tesla continuously innovates, which is evident in pacing EV range improvements, computing upgrades enabling full self-driving ability, new battery cell engineering, and factories under rapid construction.

Vertical Integration: Unlike most automakers relying heavily on suppliers, Tesla aims for vertical integration, owning its battery production, computer hardware, software IP, chip design, sensor tech, and charging infrastructure for greater scale and reduced costs.

Manufacturing & Production: Responsible for massive parallel production lines at the California and Shanghai giga factories, building record yearly volumes. Also, new state-of-the-art facilities like Gigafactories in Austin and Berlin are set to open in 2022 & 2023.

Direct Sales & Marketing: Significantly expanded retail locations, galleries, and showrooms in the past years while growing online and app-based sales coupled with referrals and influencer partnerships for targeted demand generation.

Supercharger Network Expansion: Owning charging infrastructure is a key activity supporting vehicle deployment into new regions while optimizing routes between metropolitan areas to enable long-distance travel.

Key Resources – Tesla Business Model Canvas

Proprietary Charging Network: Tesla’s vast proprietary Supercharger infrastructure is the world’s fastest EV charging network, enabling long-distance travel and essential for new market entries. Over 3,500 stations globally provide key competitive infrastructure.

Battery Technology: Continues rapid development of proprietary battery cells, packs, and production methods like tabless battery cell design or nickel cathode composites for targeted cost per kWh reductions projected to reach below $100/kWh within 2 years.

Full Self-Driving Data: Over 3 billion autonomous miles logged give Tesla what it states is the most extensive real-world AI training dataset in the industry – a uniquely valuable asset as autonomous tech matures toward commercialization between 2023-2025.

Gigafactories: The still expanding multibillion-dollar factory network (like Giga Austin, Berlin) with planned Model Y output exceeding 1 million per factory annually is a monumental investment in next-generation manufacturing capability.

Talent Acquisition: Tesla attracts many of the auto industry’s best electrical, mechanical, and software engineering minds across centers of excellence in Palo Alto, Buffalo, and now Berlin/Austin, cementing access to vital human capital.

Key Partners – Tesla Business Model Canvas

Battery & Component Suppliers: Panasonic produces Tesla-designed battery cells in Japan/Nevada. Also partners with leading global parts vendors like Samsung SDI, LG Energy, Bosch, and Continental while vertically integrating more component manufacturing in-house.

Charging Infrastructure Network: Over 55,000 Destination Charging connectors are installed globally via partnerships with hotels, restaurants, and workplaces. Also, partnering with some public EV charging networks to expand access for long-distance travel.

Utilities & Energy Providers: Partner with regional utilities like Con Edison for demand response grid services. Tesla Energy Ventures invests in solar/storage startups. Allow vehicle-to-grid 2-way power flow partnerships under early-stage exploration.

Insurance Providers: Launched partnerships with leading insurance firms in Asia/Europe to provide policies for its vehicles, leveraging real-time driver data to enable customized, lower-cost premiums.

Ride-Hailing Platforms: Early pilot programs underway providing access to Tesla ride-hailing fleet for platforms like Uber and Lyft in some North American cities. Partnerships expand brand reach and usage data.

Cost Structure – Tesla Business Model Canvas

Research & Development: Over $1.5 billion is spent annually on R&D and equipment for innovation across vehicle design, autonomous driving, manufacturing processes, battery tech, and chip development. Enables technology leadership.

New Factory Expenditures: Recent outlays exceeding $5 billion on new Gigafactories in Austin, Berlin, and planned sites over the next 3 years provide greater economies of scale but add near-term cost burdens before higher production is realized.

Raw Materials: Battery-grade metals like lithium nickel comprise rising input costs tied to volatile commodity markets. Securing low-cost access to sustain battery production with strong demand growth is an ongoing priority.

Charging Infrastructure: Owning a Supercharger network avoids user fees but requires large non-revenue generating capital expenditures estimated at hundreds of millions per year to enable expansion aligned with vehicle deployment rates.

Sales & Marketing: Retail showrooms, galleries, online/social marketing, and brand building add underlying customer acquisition costs, though Tesla spends far less than typical automakers with no third-party dealership expenses.

Summary of Tesla Business Model Canvas

Conclusion on Tesla Business Model Canvas

Tesla’s business model has uniquely enabled it to become the leading and largest electric vehicle manufacturer globally. It stands out by its focus on frequent technology and product innovation, company-owned sales & service channels, proprietary charging infrastructure, and vertical integration across critical components – combined with an aspirational brand accelerating the world’s transition to electric mobility. With strong execution, Tesla has built tremendous value and disruptive potential across multiple industries in a relatively short time span.

Hi! I am Mohammad Safayet Hossain, pursuing my BBA in Marketing at the Bangladesh University of Professionals. As a business student, I am passionate about learning about various companies and industries and am here to share them with you.