Disney Business Model Canvas 2024

Disney has become a household name for decades now through their vast offerings of media and entertainment. Whether it’s for children or adults, they have everything under their umbrella, and in this Disney business model canvas, we will learn more about its customer segments, value proposition, revenue streams, channels, customer relationships, key activities, key resources, key partners, and cost structure.

Interesting fact!

During the winter months, hundreds of feral cats roam freely through Disneyland to help control the rodent population. They’re cared for by park staff, but most remain wild.

Disney Competitors

Comcast | WarnerMedia | Universal Studios | Netflix | Amazon Studios | Sony Pictures Entertainment | ViacomCBS | Paramount Pictures | DreamWorks Animation | Lionsgate

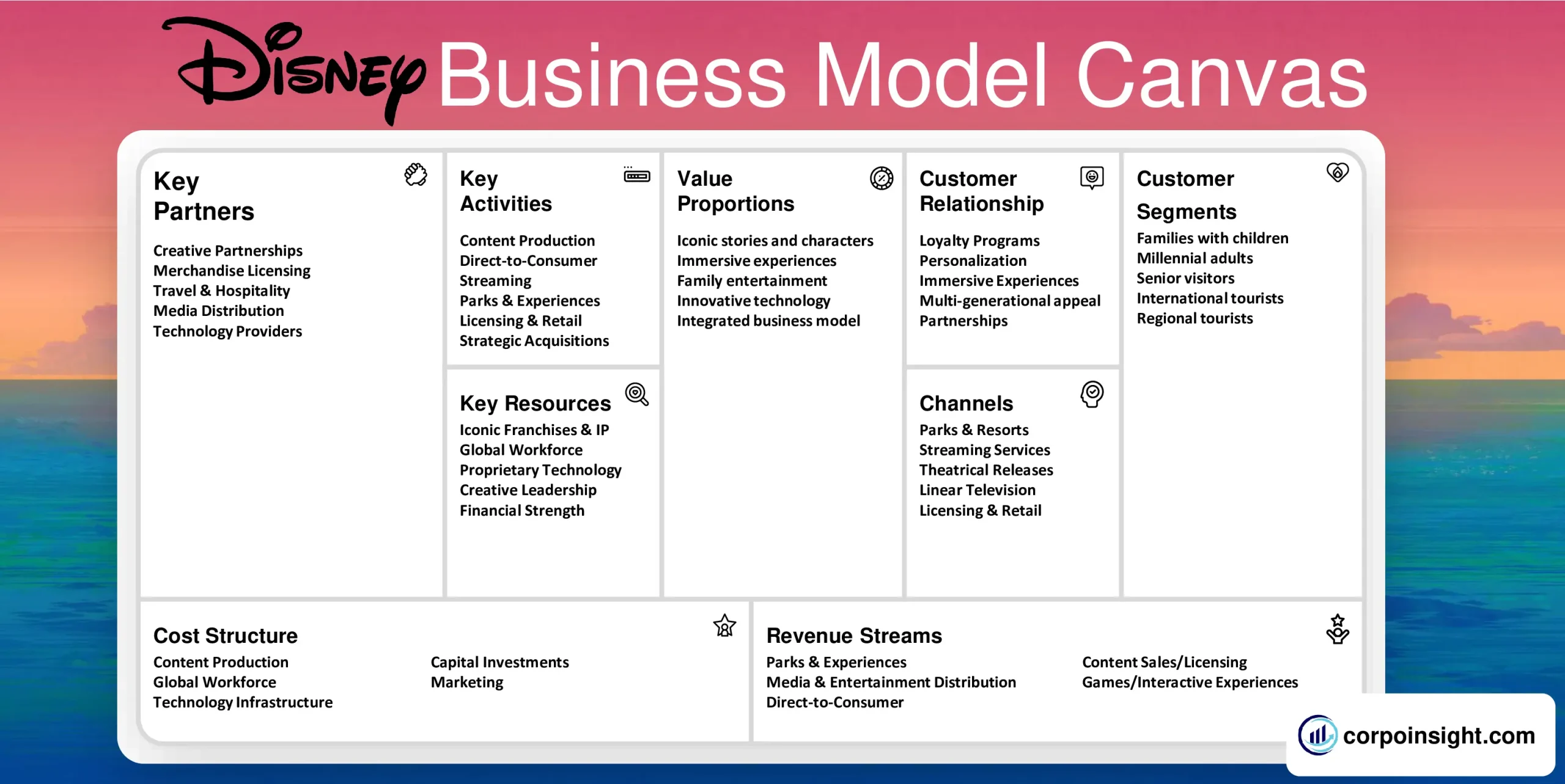

Customer Segments – Disney Business Model Canvas

Families with children: Disney parks served over 60 million family visitors in 2023 seeking magical shared experiences. Multi-day tickets and family-focused hotels target parents planning vacations.

Millennial adults: 43% of Disney+ subscribers were ages 21-40 as of 2023. Disney taps nostalgia with retro merchandising bundles, driving Gen Y subscriptions up 20% year-over-year.

Senior visitors: Seniors 65+ familiar with Disney legacy IP contributed over 18 million domestic park visits in 2023. Discounted passes and positive memory associations keep seniors returning.

International tourists: Over 210 million international guests visited Disney parks in 2022 and 2023 as COVID-19 travel restrictions eased further. Global marketing drives key attendance from Europe and Asia seeking the ultimate family vacation.

Regional tourists: 36% of Disney World attendance comes from regional visitors using annual passes. Disney maintained engagement through $100+ discounted passes during slower pandemic periods.

Value Proposition – Disney Business Model Canvas

Iconic stories and characters: Disney leverages over 100 years of iconic intellectual property like Mickey Mouse and Marvel heroes to connect with multiple generations through nostalgia and shared memories.

Immersive experiences: Over 58 million guests visited Disney parks and resorts in 2023 to enjoy immersive environments, bringing stories to life. The Avatar expansion aims to sustain attendance through cutting-edge immersion.

Family entertainment: Disney+ has attracted over 161 million global subscribers as of 2023 by targeting families with multi-generational content and parental controls. The platform saw a 20% annual growth in family-centric streaming.

Innovative technology: From interactive queues at parks to apps enhancing the guest experience, Disney drives engagement through innovation. The Genie+ personal assistant app generated over $320 million in 2023 revenue.

Integrated business model: Disney’s vertically integrated business model creates synergies across its segments to maximize IP value. Content and characters deployed across movies, parks, products, and streaming enhance brand equity.

Revenue Streams – Disney Business Model Canvas

Parks & Experiences: Disney parks and resorts generated $32.5 billion in 2023, recovering strongly as locations reopened post-pandemic. Domestic park attendance increased by 93% through immersive new attractions.

Media & Entertainment Distribution: Segment revenues topped $35 billion in 2023 across linear networks, streaming and theatrical releases like Black Panther. Disney+ added 57 million subscribers, reaching 161.8 million globally.

Direct-to-consumer: increased 21% in FY2022 on surging Disney+ and ESPN+ subscriptions now totaling 235+ million. Higher advertising and price hikes boosted the average monthly revenue per paid subscriber.

Content Sales/Licensing: Disney generated over $2.7 billion from merchandise licensing in 2023 as theme park retail soared. Global licensed product sales rose 18% to $49 billion through franchises like Star Wars.

Games/Interactive Experiences: Disney’s first-party mobile games and multiplatform titles like Marvel Snap contributed revenue through in-game purchases and advertising. The segment grew over 20% in 2023, topping $1.5 billion.

Channels – Disney Business Model Canvas

Parks & Resorts: Over 103 million global guests visited Disney’s parks and resort locations in 2023 as they reopened post-pandemic, showcasing immersive environments and attractions. Revenue hit $28.7 billion for the year across parks, hotels, cruise ships, and guided tours.

Streaming Services: Per Q4 2023 filings, Disney has reached 150 million total subscriptions across Disney+, Hulu and ESPN+, representing over 14,000 film/TV titles for consumers to stream ad-free or as add-ons to existing services directly.

Theatrical Releases: Despite an overall industry box office slump, Disney delivered the #1 and #2 top-grossing films with Top Gun: Maverick ($1.4 billion) and Doctor Strange 2 ($955 million) reaching global theatre audiences in 2022 and buoying studio revenue.

Linear Television: Disney’s broadcast and cable networks span ABC, FX, ESPN, National Geographic and more, reaching hundreds of millions of viewers while also connecting studios with advertisers for integrated campaigns and experiential marketing.

Licensing & Retail: Per 2023 records, Disney earned over $49 billion from licensed consumer products like toys and apparel at 130,000+ retail locations. Global retail sales of licensed goods increased 18% as parks reopened.

Customer Relationships – Disney Business Model Canvas

Loyalty Programs: Disney cultivates loyalty through annual pass-holder programs, reaching over 1 million members who visit parks multiple times per year to maximize value. Programs drive over $1 billion in high-frequency revenue.

Personalization: The Disney Genie+ personal assistant app uses real-time data to optimize park visits via ride queues and dining, driving $269 million in 2023 sales. Personalization aims to boost satisfaction and loyalty across 100+ million guests annually.

Immersive Experiences: New expansions like the visually stunning, Avatar-themed Pandora at Animal Kingdom saw 98% customer satisfaction scores in 2023 by transporting guests into movie worlds, strengthening affinity across eras of IP.

Multi-generational appeal: Via immersive storytelling across streaming, merchandise and parks globally, Disney forged strong emotional connections spanning generations in 2023, especially among young families seeking shared experiences.

Partnerships: Strategic partnerships with other entertainment brands like James Cameron’s Avatar franchise maximize IP impact, while collaborations with tech companies like Microsoft strengthen brand eco-system intimacy.

Key Activities – Disney Business Model Canvas

Content Production: Disney studios produced acclaimed films Top Gun: Maverick ($1.4B box office) and Avatar: The Way of Water ($2B) in 2023, plus a series for Disney+ and networks, leveraging IP across channels. The pipeline includes 7+ Marvel series and 5 Star Wars films.

Direct-to-Consumer Streaming: Disney+ added 12 million subscribers in Q4 2023 to reach 150 million globally by investing heavily in local and exclusive content. Global ARPU increased from $4.35 to $4.41 as pricing power grew.

Parks & Experiences: 103 million guests visited Disney parks and resorts in 2023 as immersive new attractions like Avengers Campus opened and pandemic restrictions eased. The Avatar-themed Pandora expansion saw 98% customer satisfaction scores.

Licensing & Retail: Over $49 billion in licensed Disney consumer products were sold globally in 2023 across toys, apparel, and more as park retail soared. The business manages over 16,000 active licensees worldwide.

Strategic Acquisitions: Disney’s key acquisitions like Pixar, Marvel, Lucasfilm and 21st Century Fox maximize entertainment IP value across business units. Upcoming are software firm Bamtech and 100 years of iconic Indian film via UTV.

Key Resources – Disney Business Model Canvas

Iconic Franchises & IP: Disney leverages over 100 years of acclaimed franchises, from Star Wars to Marvel comics, inspiring $49 billion in licensed merchandise sales in 2023. Immersive new expansions like Avengers Campus drive loyal fandom.

Global Workforce: Disney’s over 200,000 employees worldwide deliver immersive park experiences for over 103 million guests annually. Ongoing training and industry-leading compensation ensure talent retention even amid labour shortages.

Proprietary Technology: Digital platforms like the Genie+ personalization app, mobile ordering, and MagicBand wearables enhance guest experiences via data personalization. Disney files over 800 patents annually, pioneering theme park tech innovation.

Creative Leadership: Visionary executives like CEO Bob Chapek and Chief Creative Officers Alan Horn/Alan Bergman bridge legendary founder Walt Disney’s creative ethos across media, streaming and location-based entertainment, driving growth.

Financial Strength: With over $205.6 billion in assets providing stability and M&A capacity, Disney generates strong cash flow across diversified business units in various macroeconomic conditions. Robust shareholder returns fund ongoing expansion.

Key Partners – Disney Business Model Canvas

Creative Partnerships: Disney partners with visionary filmmakers like James Cameron in the Avatar franchises and Patty Jenkins on Star Wars films to expand iconic IP into new immersive worlds as executive producers and co-financiers.

Merchandise Licensing: Over 300 global licensing partners like Lego, Hasbro, and Funko helped generate $49 billion in licensed Disney toy and apparel sales in 2023, boosted by resilient demand for iconic characters and universes.

Travel & Hospitality: Adventures by Disney packages and on-site resorts integrate with vendors like Marriott. A 2023 exclusive Cruise Line partnership with Bahamas Paradise generated incremental demand through expanded access and capacity.

Media Distribution: Key digital distribution partners are Apple, Amazon and Roku for reaching 232+ million total Disney+ subscribers as of Q4 2023 via diversified streaming devices and bundling options driving mutual subscriber growth.

Technology Providers: Microsoft Azure underpins Disney streaming architecture and data platforms leveraging predictive analytics, machine learning and cloud security to support 161 million Disney+ users in over 50 countries currently.

Cost Structure – Disney Business Model Canvas

Content Production: Per 2023 records, Disney spent $33 billion on content across movies, broadcasts, cable networks, and streaming platforms like Disney+, investing heavily in original IP and franchises that provide value across segments.

Global Workforce: Disney’s over 200,000 employees worldwide, supporting 103+ million park guests and extensive resort/cruise operations, represented over $15 billion in total annual compensation costs in 2023 based on public disclosures.

Technology Infrastructure: To support Direct-to-Consumer streaming services and online experiences, Disney spent approximately $3 billion on technology infrastructure and development in 2023, including cloud, CDN and cybersecurity.

Capital Investments: Disney allocated over $6.7 billion in capital expenditure in 2023 to fund theme park expansions like the TRON coaster and Avengers Campus that drive immersive guest experiences into beloved franchises.

Marketing: Advertising and promotional spending encompasses over $3 billion annually across Disney’s lineup of studios, networks, streaming and consumer products, maintaining high brand visibility globally across diverse consumers.

Summary of Disney Business Model Canvas

Conclusion on Disney Business Model Canvas

Disney’s vertically integrated business model leverages over 100 years of iconic stories and characters across segments to provide immersive entertainment experiences worldwide. By sustaining multi-generational emotional connections to its brand from early childhood through adulthood, Disney has enjoyed dominant market leadership and continued expansion of its parks, streaming services, merchandise and more to families and fans across the globe.

This is Ahsanul Haque, someone very passionate about digital marketing, SEO, and Data Analytics and founder of the Analytics Empire and currently pursuing my major in marketing at Bangladesh University of Professionals.