Netflix Business Model Canvas 2024

Netflix is one of those companies that can come into the market and disrupt the traditional way of how things used to work, and the company did that exactly. In this Netflix business model canvas, we will learn its customer segments, value proposition, revenue streams, channels, customer relationships, key activities, key resources, key partners, and cost structure.

Interesting Facts!

Netflix sent Amazon a cactus as a “congratulations” gift in 2002 after Amazon won a patent dispute between the companies related to 1-click ordering.

Netflix Competitors

Amazon Prime Video | Hulu | Disney+ | HBO Max | Apple TV+ | YouTube Premium | CBS All Access | Peacock | HBO Go | Sling TV

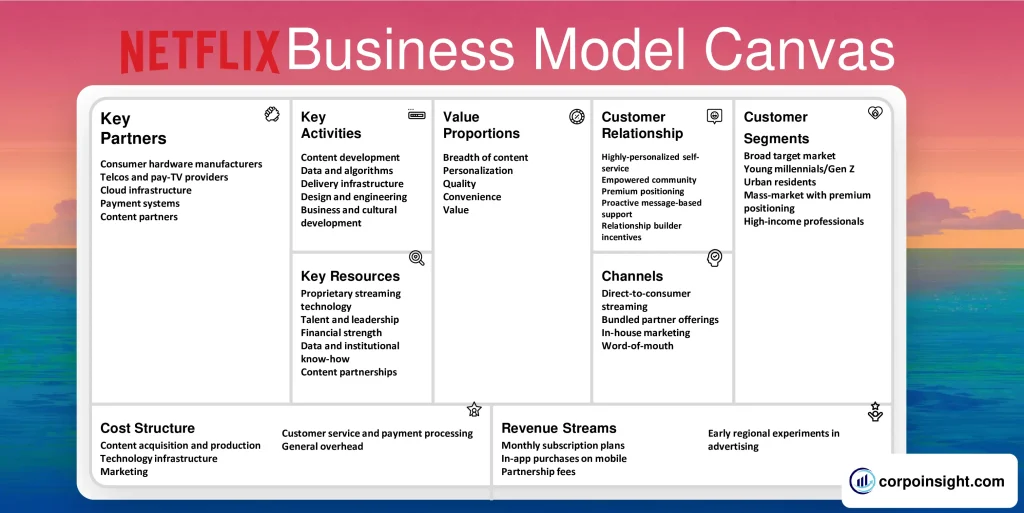

Customer Segments – Netflix Business Model Canvas

Broad target market: Netflix targets primarily English-speaking consumers with internet access across the globe seeking low-cost entertainment streaming options.

Young millennials/Gen Z are the heaviest users, given their digital native status and appetite for Netflix Originals: According to 2021 data, over half of Netflix viewers were under age 35. However, usage is high across age groups.

Urban residents index higher for Netflix usage than other geographic categories, given access, income, and lifestyle: Over 70% of Netflix’s revenue comes from urban subscribers across North and Latin America, along with Europe and Asia Pacific.

Mass-market with premium positioning—a truly horizontal offering meeting entertainment needs for diverse income segments worldwide by investing heavily in localized content: As low as $3 per month in some Southeast Asian markets but $17.99 per month for premium plans in North America.

High-income professionals willing to pay for ad-free entertainment and multi-user family plans are an especially attractive, high-lifetime-value segment. Average revenue per membership exceeds $14.50 in key Western European and North American markets.

Value Proposition – Netflix Business Model Canvas

Breadth of content: With over 3,000 titles and growing, Netflix offers an unmatched selection of TV shows, movies, documentaries, and other programming across virtually every genre—from Stranger Things to The Crown.

Personalization: Using sophisticated algorithms tracking billions of signals, Netflix tailors recommendations and the browsing interface to each subscriber’s taste profile for an individualized experience.

Quality: By spending over $17 billion on content in 2022 while attracting world-class creative talent, Netflix is aggressively pursuing premium, award-winning originals like Roma and Don’t Look Up.

Convenience: Subscribers enjoy binge-able, ad-free programming on-demand on their internet-connected screens—no rigid network schedules or appointment viewing required. App functionality enhances mobility.

Value: Starting at just $9.99 per month for HD streaming on 1 screen to $19.99 for premium 4K Ultra HD across 4 screens, Netflix offers affordable quality and flexibility not found in traditional cable TV packages costing much more.

Revenue Streams – Netflix Business Model Canvas

Monthly subscription plans: The vast majority of Netflix’s $29.7 billion in 2021 revenues comes from over 220 million members across three tiers—Basic, Standard, and Premium—priced at increasing points based on features. Plans auto-renew until cancellation.

In-app purchases on mobile: Users can pay via the iOS or Android apps for their subscription, which allows Netflix to avoid fees paid on in-app purchases made on native platforms. This revenue is relatively small but boosts margins.

Partnership fees: Revenue sharing for bundled telco and pay-TV packages, including a Netflix subscription, helps expand distribution into legacy entertainment bundles while partners cover customer acquisition costs.

Early regional experiments in advertising: After years of advertising-free, Netflix is exploring opt-in ad support, possibly in partnership with Google, to substantially expand its addressable market by reducing price sensitivity.

Channels – Netflix Business Model Canvas

Direct-to-consumer streaming: Netflix reaches customers predominantly through its owned apps and web platform, maintaining control over subscriber data and the full user experience from sign-up to streaming. This drives 86% of new sign-ups.

Bundled partner offerings: Distribution partnerships embed Netflix in pay-TV and mobile data plans from major providers like T-Mobile. This expands reach efficiently, while 14% of new members join via partner bundles.

In-house marketing: As a pure-play streamer, Netflix employs data-driven digital marketing, including personalization and targeting based on media consumption patterns to optimize spending across search, social, in-app, and display channels.

Word-of-mouth: Existing subscribers drive growth through member referrals and organic social buzz fueled by cultural sensation hits like Squid Game—45% of new members join without paid marketing influence. Viral in-house creative keeps costs down.

Customer Relationships – Netflix Business Model Canvas

Highly personalized self-service: Powerful recommendation algorithms deliver a tailored self-service media experience requiring little direct support—over 80% of viewing is driven by the streaming platform itself.

Empowered community: Users participate in community features like ratings/reviews and can influence future content through viewership and engagement data visible to Netflix, predicting breakout potential.

Premium positioning: Netflix cultivates an air of privilege with ad-free, uninterrupted streaming, high-end originals, and premium pricing hinting at status—no discounts or special treatment typical of mass-market services.

Proactive message-based support: Profile-based self-help resources reduce inquiries, but multi-channel customer service via in-app messaging, email, social media, and phone aims to resolve issues preemptively when they do arise.

Relationship builder incentives: Free month trial promotions encourage sign-ups from fence-sitters while account sharing among families helps make Netflix ubiquitous and shapes consumption habits long-term across generations.

Key Activities – Netflix Business Model Canvas

Content development: Netflix invests heavily in original programming, releasing films and series across virtually every major genre—recent hits like Squid Game highlight in-house content production on a global scale.

Data and algorithms: Netflix processes trillions of streaming signals to power its industry-leading personalization algorithm development through initiatives like the Netflix Recommender System Grand Prize for ML improvements.

Delivery infrastructure: Netflix maintains advanced cloud-based streaming and download functionality for seamless globally scaled distribution across over 190 countries without lags or delays, even for top simultaneous viewership.

Design and engineering: With over 5,800 technical employees, Netflix emphasizes consistent iterative improvements to its consumer user experience—features like mobile downloads cater to an increasingly mobile-first media viewing shift.

Business and cultural development: Commercial partnerships expand Netflix’s distribution channels and payment options in new markets while local content investments reflect regional tastes and culture, attracting international audiences.

Key Resources – Netflix Business Model Canvas

Proprietary streaming technology: Having pioneered video streaming over 15 years ago, Netflix has iterated award-winning in-house technology for UI, personalization algorithms, and cloud delivery infrastructure that serves over 220 million subscribers.

Talent and leadership: Reed Hastings sets the vision as a pioneering CEO while recruitment of exceptional creative talent and engineers drives innovation—Netflix employs over 11,400 people in the core streaming business.

Financial strength: With over $30 billion in revenue funding content investments well above rivals and supporting expansion into games, ads, and merchandise, Netflix maintains the flexibility to pursue emerging opportunities aggressively.

Data and institutional know-how: Over 25 years of grooming video streaming expertise plus related datasets on a scale that dwarfs competition constitutes an invaluable strategic asset informing key decisions through analytics.

Content partnerships: Deals with external studios like 21st Century Fox and Universal Pictures allow Netflix to offer beloved franchises from Back to the Future to Jurassic World alongside flagship original hits.

Key Partners – Netflix Business Model Canvas

Consumer hardware manufacturers: Platform partnerships with Apple, Google, Roku, smart TV makers, and game console producers pre-install Netflix apps for simplified access, helping expand its footprint across streaming devices globally.

Telcos and pay-TV providers: Bundling agreements to include Netflix with cable/internet/mobile plans like Virgin Media in the UK and SK Telecom in South Korea provide additional customer acquisition channels, especially in emerging markets.

Cloud infrastructure: Netflix relies on AWS and leverages dozens of other cloud services to maintain uptime and rapid capacity provisioning for its massive, fluctuating requirements as a streaming leader handling gigantic traffic spikes from Stranger Things seasons and hit movies.

Payment systems: Integrations with established payment platforms, including Visa, PayPal, and carrier billing in developing regions streamline frictionless subscription transactions and recurring billing in over 190 countries.

Content partners: Key entertainment giants like Sony Pictures, Warner Bros., Universal, and 21st Century Fox license back catalogs and ongoing franchise access to augment Netflix’s original content investments with beloved existing IP.

Cost Structure – Netflix Business Model Canvas

Content acquisition and production: Netflix spends over $17 billion annually on licensed and original video content across movies, series and documentaries as its largest cost category—vital for attracting new subscribers and retaining existing ones.

Technology infrastructure: Industry-leading personalization algorithms, streaming delivery technology, and related R&D require substantial ongoing investment—over $2.8 billion in tech/development costs in 2021 reflect Netflix’s commitment to excelling in core competencies rather than outsourcing.

Marketing: Data-driven advertising across search, social, display, and other digital channels is Netflix’s second largest budget line item, exceeding $2.2 billion in 2021 alone to drive new membership sign-ups, especially in increasingly saturated developed markets.

Customer service and payment processing: Credit card fees, customer support, and related administrative overheads associated with 220 million worldwide subscribers represent a lower but still meaningful cost pool, given Netflix’s direct-to-consumer model.

General overhead: Facilities, corporate functions like HR/finance, and related fixed costs are relatively low compared to variable subscriber-related expenses, consistent with the operational leverage in Netflix’s streaming business model.

Summary of Netflix Business Model Canvas

Conclusion on Netflix Business Model Canvas

Through vast investments in premium original content, advanced personalization technology, and global streaming delivery infrastructure, Netflix has pioneered a direct-to-consumer entertainment model that leverages compelling programming, algorithmic matching, and flexible plans to serve the individual tastes of over 220 million subscriber households worldwide. This member-centric digital platform built around internet video-on-demand has evolved into the leading paid streaming service globally.

Majoring in marketing from Bangladesh University of Professionals, Sadman Abrar is a learner, obsessed with branding and intrigued to learn about different company strategies, and currently working at bKash.