Nvidia Business Model Canvas 2024

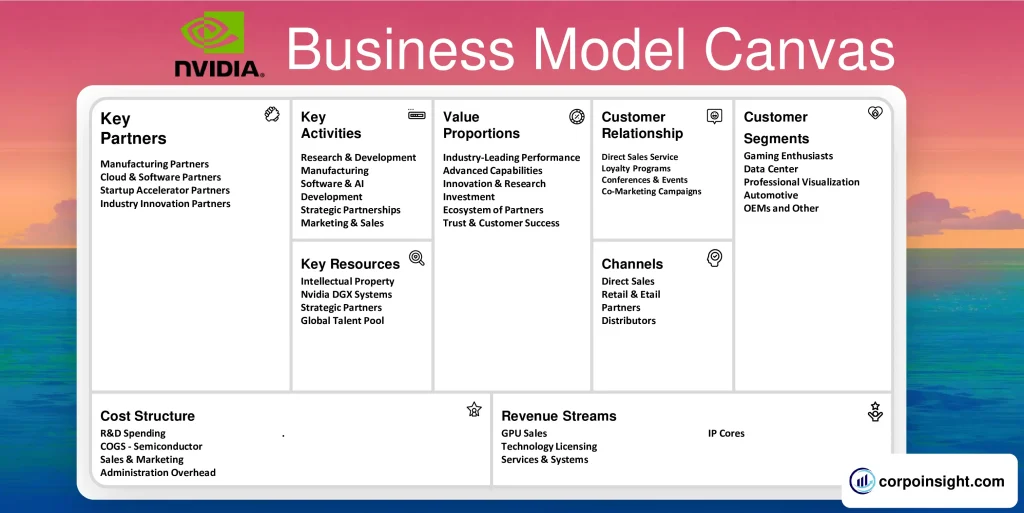

Nvidia is one of those biggest companies that shaped the technology in today’s world, and without them, it would’ve been impossible to reach the graphical milestone. We will get to know about the company in this Nvidia business model canvas, along with its customer segments, value proposition, revenue streams, channels, customer relationships, key activities, key resources, key partners, and cost structure.

Interesting fact!

Huang, who has led Nvidia for over 27 years since its founding in 1993, is known for wearing black leather jackets when announcing major products. It’s become part of his personal brand.

Nvidia Competitors

AMD | Intel | Qualcomm | IBM | Google | Microsoft | Apple | Samsung | ARM | Xilinx

Customer Segments – Nvidia Business Model Canvas

Gaming Enthusiasts: A massive market of over 200 million PC gamers as well as millions of console gamers buying graphics-intensive titles that demand high GPU performance. Customers in this segment purchased $8.7 billion in GeForce gaming GPUs in FY23.

Data Center: Cloud computing providers, high-performance computing firms, and hyperscale data centers purchasing Nvidia data center GPUs and AI accelerators. This was Nvidia’s largest and fastest-growing segment, with FY23 revenue of $11.6 billion, up 53% YoY.

Professional Visualization: Media creators, architects, and product designers buy high-end Quadro GPUs to enable photorealistic rendering and complex designs. Generated $1.8 billion in revenue in FY23 through a niche market for Nvidia.

Automotive: Major global automakers using Nvidia DRIVE platforms for in-vehicle infotainment displays, Advanced Driver Assistance Systems (ADAS), and autonomous driving development. It is expected to be a crucial future segment as vehicles get smarter.

OEMs and Other: Companies embedding Nvidia GPUs or AI technology into devices and platforms across 5G infrastructure, robotics, and more. Still, an emerging customer segment contributed $1.1 billion in FY23 revenue.

Value Proposition – Nvidia Business Model Canvas

Industry-Leading Performance: Nvidia GPUs offer substantial speed boosts over competitors; their new RTX 4090 GPU provides up to 2 times faster ray tracing than the prior generation.

Advanced Capabilities: Products incorporate the latest technology like AI, photorealistic rendering, VR, and cloud-native support that competitors cannot match. Ex – Omniverse platform for 3D design collaboration.

Innovation & Research Investment: Over $4.1 billion was spent on R&D in fiscal year 2023 alone to rapidly deliver groundbreaking products with new functionality to customers earlier than rivals.

An ecosystem of Developers & Partners: Over 200,000 developers create on Nvidia platforms, leveraging 8,000+ GPU-optimized applications to enhance productivity and efficiency for end customers across segments.

Trust & Customer Success: Longstanding partnerships with major companies like Amazon, Microsoft, and Walmart highlight the ability to not just sell technology but also make customers successfully leverage it. Enterprise customer retention rate over 90%.

Revenue Streams – Nvidia Business Model Canvas

GPU Sales: $15.7 billion in FY23 revenue from sales of GPU chipsets and boards directly to end customers across gaming, professional visualization, data center, and auto segments. Pricing power in premium GPUs for gaming and data centers.

Technology Licensing: $1.3 billion in platform & IP licensing plus royalties in FY23. Licensing Nvidia technology for gaming consoles, tablets, automotive infotainment systems, and edge AI/robotics applications. High-margin revenue stream.

Services & Systems: $1.1 billion in FY23 revenue from enterprise support services and data center / cloud-native systems that leverage internally designed GPUs and networking tech. Sticky recurring service contracts.

IP Cores: Licensing of Nvidia intellectual property like GPU architectures, ray tracing, and ARM CPU cores for customers to incorporate into their own custom chip designs. A specialty high-margin revenue segment.

Channels – Nvidia Business Model Canvas

Direct Sales: $9.2 billion in FY23 revenue from Nvidia’s global salesforce working directly with large OEM partners, cloud service providers, automotive companies, and enterprise customers for bulk orders. Dedicated industry-specific sales teams.

Etail & Retail: $6.5 billion in FY23 revenue from consumer GPUs and graphics cards sold through online retailers like Amazon as well as brick-and-mortar chains like Best Buy. Makes high-end GPUs accessible to gaming enthusiasts globally.

Partners: Works with leading computer manufacturers like HP, Dell, and Lenovo to integrate GPUs into pre-built systems, workstations, and laptops for corporate and creative professional customers. Expanding reach.

Distributors: Leverages a global network of specialized distributors like Ingram Micro to enable smaller regional enterprises, public sector clients, and universities to gain access to the full Nvidia product line from boards to systems.

Customer Relationships – Nvidia Business Model Canvas

Direct Sales Service: Nvidia’s enterprise sales team provides dedicated account management and technical support to large customers like Microsoft, Amazon, and Volkswagen for complex implementation needs and long-term partnership nurturing.

Loyalty Programs: Cultivates strong relationships with gaming enthusiasts via GeForce community forums, beta-tests new products, highlights fan creations, and offers special giveaways/rewards programs.

Conferences & Events: Hosts 5 major developer conferences globally to showcase the latest GPU capabilities, secure customer feedback, provide hands-on education/training, and directly engage over 55,000 attendees annually.

Co-Marketing Campaigns: Collaborates extensively on integrated marketing campaigns highlighting customer use cases and joint solutions built with partners like Mercedes-Benz, Nintendo, and Adobe to accelerate awareness and demand generation.

Key Activities – Nvidia Business Model Canvas

Research & Development: Heavily invest in R&D for advanced GPU architecture, chip design, and programming, amounting to $4.1 billion in FY23. Enables a rapid pace of cutting-edge product releases to lead the industry.

Manufacturing: Both designs internally and partner with third-party semiconductor fabricators like TSMC for precision manufacturing of GPU chips. Adheres to industry-leading quality standards and supply chain management.

Software & AI Development: Develops supporting software like CUDA parallel programming tools as well as AI frameworks like TensorRT used by millions of developers & researchers to enhance GPU functionality.

Strategic Partnerships: Pursues co-development partnerships with industry leaders like Mercedes, AWS, Nintendo, and key acquisition targets to expand capabilities and access new markets ahead of competition.

Marketing & Sales: Significant investment into both digital marketing and specialized sales teams to generate awareness and demand with gaming enthusiasts, enterprises, automakers, and AI researchers globally.

Key Resources – Nvidia Business Model Canvas

Intellectual Property: Extensive IP portfolio with over 11,000 granted and pending patents covering GPU architecture, graphics rendering, artificial intelligence, quantum computing, and self-driving tech, providing sustained competitive advantage.

Nvidia DGX Systems: Proprietary lines like DGX for AI supercomputing and DGX workstations purpose-built for industry applications leveraging Nvidia GPUs and networking tech; a key revenue driver at over $1 billion annually.

Strategic Partners: Key long-term relationships with partners like TSMC, Samsung, and Foxconn for leading-edge manufacturing; Microsoft, Amazon, and Volkswagen on the customer side provide Nvidia scale and insights into future plans.

Global Talent Pool: With over 7,400 software engineers and technology talent globally across 20 countries, Nvidia has best-in-class capabilities around chip design/programming on high-growth technologies like AI and robotics.

Key Partners – Nvidia Business Model Canvas

Manufacturing Partners: Strategic relationships with TSMC, Samsung, and Foxconn for leading-edge semiconductor fabrication and capacity ensure a reliable, scalable supply chain to meet surging GPU demand, especially for data center and auto.

Cloud & Software Partners: Close engineering collaboration with cloud majors AWS, Google Cloud, and Microsoft Azure to optimize Nvidia GPUs and networking for next-gen workloads. Also, there is tight integration with AI software firms like MathWorks.

Startup Accelerator Partners: The Nvidia Inception program nurtures over 8,500 AI, data science, and autonomous vehicle startups by providing GPU cloud credits, training, and support. Accelerating new solutions harnessing Nvidia technology.

Industry Innovation Partners: Joint R&D pacts with Mercedes, Jaguar Land Rover, Florida Hospital, and others to co-develop next-gen applications in smart cities, digital health, and self-driving cars, leveraging Nvidia’s investment.

Cost Structure – Nvidia Business Model Canvas

R&D Spending: The highest cost is the $4.1 billion annually invested into global research and technology development to achieve product leadership in advanced GPUs and new growth areas like quantum computing.

COGS – Semiconductor: The significant cost of goods sold tied to production, packaging, and testing of GPUs and systems by third-party manufacturing partners like TSMC and Samsung is 35% of revenue. Offsets some R&D.

Sales & Marketing: With $1.3 billion spent on global salesforce, promotional budgets, and brand marketing in FY23, demand generation is the third largest operating expenditure, though yielding high revenue growth.

Administration Overhead: General corporate services, legal, finance, and HR costs make up roughly 7% of revenue. Kept low through strong expense discipline even while pursuing aggressive expansion goals.

Summary of Nvidia Business Model Canvas

Conclusion on Nvidia Business Model Canvas

Nvidia’s pioneering business model is centered around leveraging its industry-leading R&D and intellectual property in advanced GPUs and AI to deliver unparalleled products and platforms to customers across gaming, data centers, autos, and more. Its substantial investments in talent, partnerships, and global sales have created the standard for platform innovation and fuel surging growth across existing and emerging technology segments.

This is Ahsanul Haque, someone very passionate about digital marketing, SEO, and Data Analytics and founder of the Analytics Empire and currently pursuing my major in marketing at Bangladesh University of Professionals.